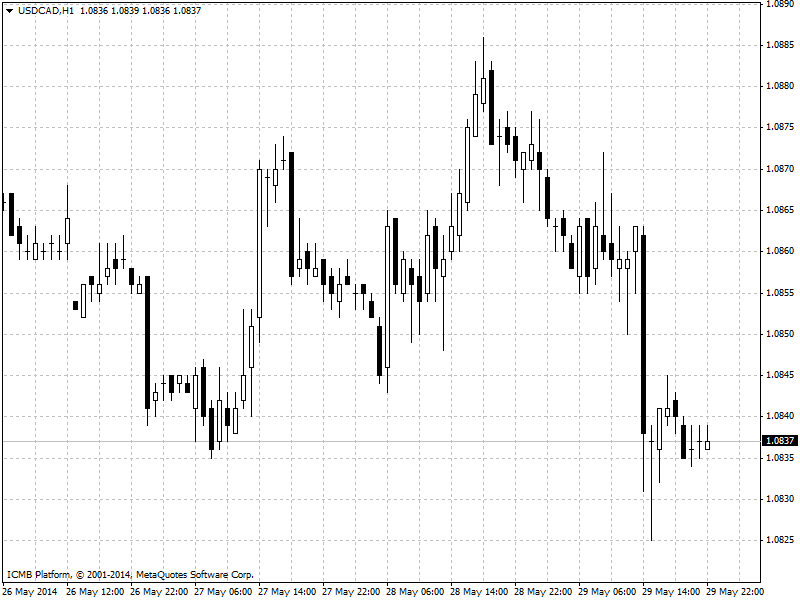

EUR/USD

European Central Bank President Draught’s pledge to buy bonds from euro-region governments is allowing the independence movement in Catalonia to advance its cause without facing resistance from investors. While Draghi took credit for salvaging the euro by creating a program to buy a government debt in 2012, that commitment is also allowing politicians to sidestep the market discipline that might otherwise check their bolder ambitions. A Catalan secession would cost Spain 10 percent of its tax revenue and trigger a row over how to carve up the sovereign’s 836 billion euros ($1.1 trillion) of debt.

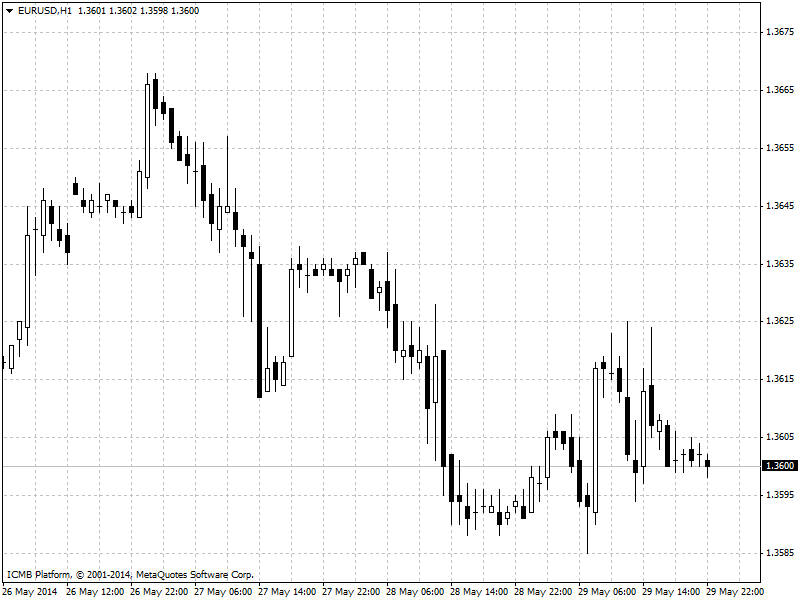

GBP/USD

The pound headed for its biggest monthly drop against the dollarsSterling slipped for a fifth day against the euro, reaching the weakest level in more than a week, even after Martin Weale, external member of the Monetary Policy Committee, said he sees borrowing costs rising by as much as 1 percent per year once the central bank starts tightening policy. U.K. government bonds rose for a second day, sending 10-year yields to the lowest since August. The pound was little changed at $1.6723 at 4:08 p.m. London time, headed for a monthly decline of 0.9 percent. It earlier reached $1.6693, the least since April 15. Sterling traded at 81.43 pence per euro after slipping to 81.53 pence, the weakest since May 20.

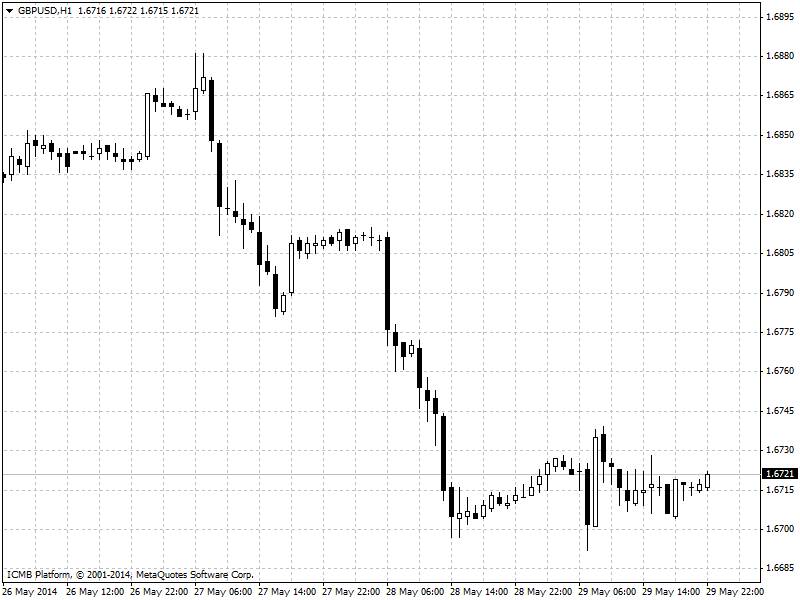

USD/JPY

The Bank of Japan revised guidance for its government bond purchases for a third time since it began unprecedented easing last year, reflecting challenges Governor Haruhiko Kuroda faces in relating the economy. Price growth in Japan excluding fresh food rose to 3.2 percent in April, up from 1.3 percent in March and beating the 3.1 percent median estimate in a Bloomberg survey, after an increase in sales tax. A bigger-than-estimated 1 percent drop in first-quarter U.S. gross domestic product spurred some economists to boost growth forecasts, saying the decline was due to cuts in inventory building that won’t last.

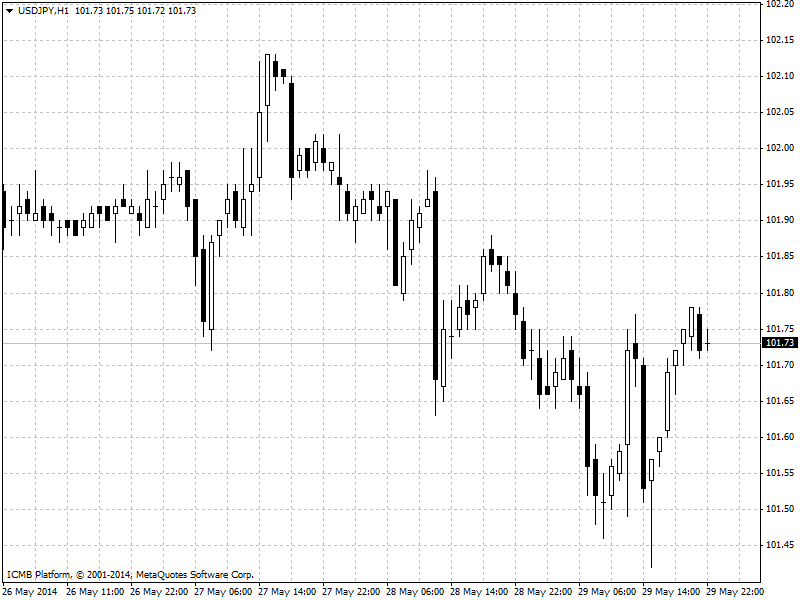

USD/CAD

Canada’s largest pension fund invested in Alibaba, the e-commerce company on two fronts: a $100 million direct investment in 2011 and a C$465 million ($450 million) commitment to a fund run by Silver Lake Management LLC, a U.S. private-equity firm that also owns a small share of Alibaba, filings show. Alibaba’s valuation has risen five-fold in less than three years; the fund hired Agus Tandiono, a former Citadel LLC manager, in January in a push to expand investments in publicly traded stocks in Asia. Tandiono joined its Hong Kong-based unit, CPPIB Asia Inc., which is run by former Goldman Sachs Group Inc. (NYSE:GS) banker Mark Machin.