Tuesday's trading session has been relatively quiet with little major economic news to create a huge volatility in the currency market. The greenback held its momentum against the euro and remained flat, holding steady around $1.2400 level. The Italian economy remained stuck in recession in the second quarter as austerity measures weighed heavily on economic activity. The fourth successive contraction has raised concerns about the ability of the government to bring order to its public finances.

Gross domestic product dropped 0.7 percent, slower than the 0.8 percent decline in the previous quarter, preliminary data from the statistical office Istat showed. The figure came in line with analyst anticipation. Prime Minister Mario Monti warned Europe that the region is facing the threat of a psychological disintegration due to the impact of the debt crisis, in an interview over the weekend.

Meanwhile, German factory orders declined more-than-expected in June as both domestic and foreign demand deteriorated, escalating fears that the largest economy in the euro-periphery shrunk in the second quarter. Factory orders fell 1.7 percent month-on-month, data from the Federal Ministry of Economy and Technology showed. The actual figure came worst than anticipated. EUR/USD" title="EUR/USD" width="1358" height="579">

EUR/USD" title="EUR/USD" width="1358" height="579">

GBP/USD

The British currency strengthened earlier of Tuesday against the greenback as retail sales soared surprisingly. Retail sales in the United Kingdom rose unexpectedly in July as warm weather and ongoing Olympics boosted sales of food and drinks, a report from the British Retail Consortium (BRC) revealed. Its values rose 0.1 percent on a year-on-year in July in contrast from analyst had predicted of 0.2 percent drop.

Sterling reversed its gains after production in the British industrial and manufacturing sectors shrank in June mainly due to extra holidays for the Queen's Diamond Jubilee celebrations, the latest figures from the Office for National Statistics (ONS) revealed. However, the decline was not as steeper as expected and is likely to lead to an upward revision in the second quarter GDP figures. Industrial production fell 2.5 percent compared to expectations for a 3.5 percent drop while manufacturing production declined 2.9 percent from an expected 3.9 percent drop. Production has now fallen for fifteen consecutive months. GBP/USD" title="GBP/USD" width="1358" height="579">

GBP/USD" title="GBP/USD" width="1358" height="579">

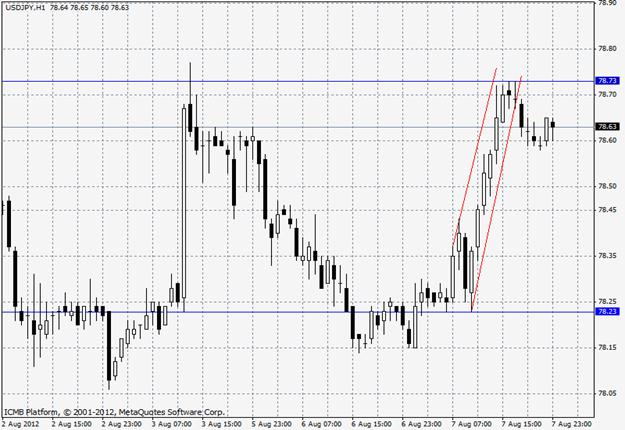

USD/JPY

The Tokyo Stock Exchange Group Inc.’s second major system error in seven months took derivatives trading offline for 95 minutes and underscored the challenge Japan faces to revive its reputation as a global equity hub. Share trading volumes fell, government bonds dropped and index-futures traders were diverted to Tokyo’s smaller Osaka rival during the halt which lasted from 9:22 a.m. to 10:55 a.m. local time. The error was compounded by a failure of backup systems similar to that which caused the biggest disruption in six years on 2nd of Feb., said Hiroaki Uji, director of trading systems at the bourse.

The outage which affected stock-index and government-bond futures and options is a further setback for the Tokyo exchange as it pursues a takeover bid for the Osaka bourse which dominates Japan’s equity derivatives business. The breakdown also highlights the vulnerability of global markets to computer malfunctions, a week after errors at market-maker Knight Capital Group Inc. led to wrong trades for more than 100 U.S. stocks.

Japan’s reputation as a financial hub has been battered as more than two decades of equity losses and economic stagnation have combined with corporate governance scandals. Poor management at Tokyo Electric Power Co. was blamed in part for last year’s nuclear disaster, while senior board members of Olympus Corp. were found to have hidden losses through inflated fees after they fired whistle-blowing president Woodford in October.  USD/JPY" title="USD/JPY" width="1358" height="579">

USD/JPY" title="USD/JPY" width="1358" height="579">

USD/CAD

Canada’s dollar advanced to the strongest level in three months against its U.S. counterpart as risk appetite swelled and stocks and crude oil, the nation’s biggest export, climbed. The currency gained versus all of its 16 most-traded counterparts except the Norwegian krone after a gauge of Canadian business spending increased more than forecast. Federal Reserve of Boston President Eric Rosengren called for “open-ended” monetary easing and Germany’s government backed a European Central Bank bond-buying plan, a spokesman said.

The loonie for the image of the aquatic bird on the CAD 1 coin appreciated 0.3 percent to 99.70 cents at 5 p.m. in Toronto and reached 99.63 cents, the strongest since 11th of May. One Canadian dollar buys $1.003. Canadian government bonds dropped for a second day, pushing the benchmark 10-year yield up nine basis points, or 0.09 percentage point, to 1.84 percent. It touched 1.85 percent, the highest level since June 7. The price of the 2.75 percent security due in June 2022 fell 87 cents to CAD 108.13.  USD/CAD" title="USD/CAD" width="1358" height="579">

USD/CAD" title="USD/CAD" width="1358" height="579">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis: August 08, 2012

Published 08/08/2012, 06:27 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis: August 08, 2012

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.