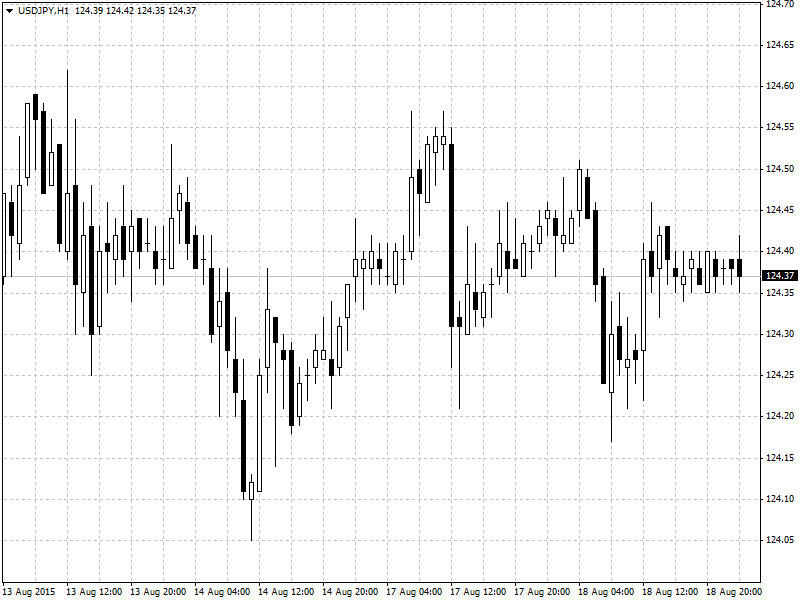

EUR/USD

Euro fell sharply, extending its recent losing streak to five, ahead of the release of the Federal Open Market Committee's minutes from its July meeting on Wednesday afternoon. EUR/USD has erased all of its gains in the five successive sessions to close below 1.11 for the third consecutive day. Still, the euro remains up against its American counterpart by more than 1.8% over the last month of trading, as investors continue to price in a possible interest rate hike by the Federal Reserve during its next FOMC meeting in mid-September. Traders abandoned their long positions in the euro on Tuesday, ahead of the Federal Reserve's release of the minutes from its July meeting on Wednesday afternoon. While Fed chair Janet Yellen has indicated that the FOMC could lift interest rates at some point in 2015 if the economy and labor markets continue to show improvement, the Fed has been tight-lipped as to whether lift-off will occur in September.

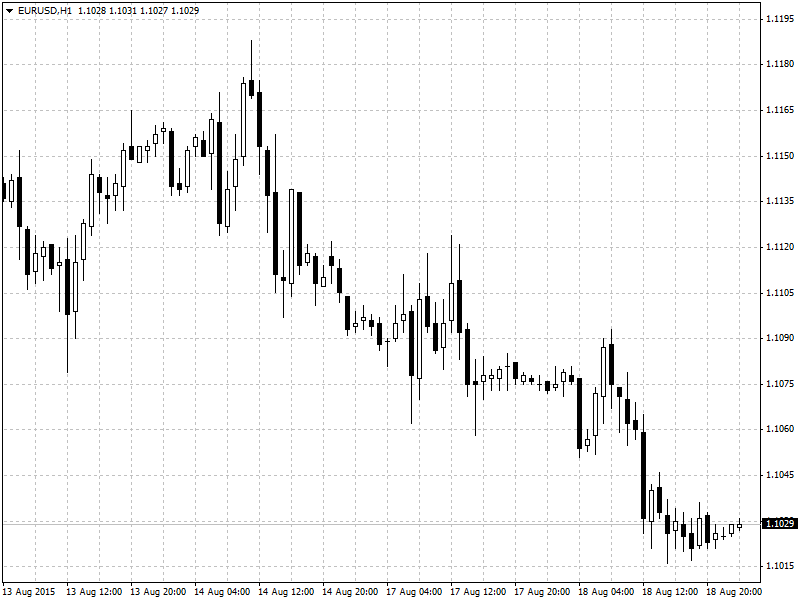

GBP/USD

The pound rallied to session highs against the dollar and the euro on Tuesday, after data showed that U.K. consumer prices rose unexpectedly last month, adding to pressure on the Bank of England to raise interest rates. The move higher in sterling came after the Office for National Statistics said the consumer price index ticked up 0.1% in July compared to the same month last year, after falling to zero in June. Economists had expected a flat reading. The slight increase was due mainly to smaller price reductions on clothing compared to a year ago, the ONS said.

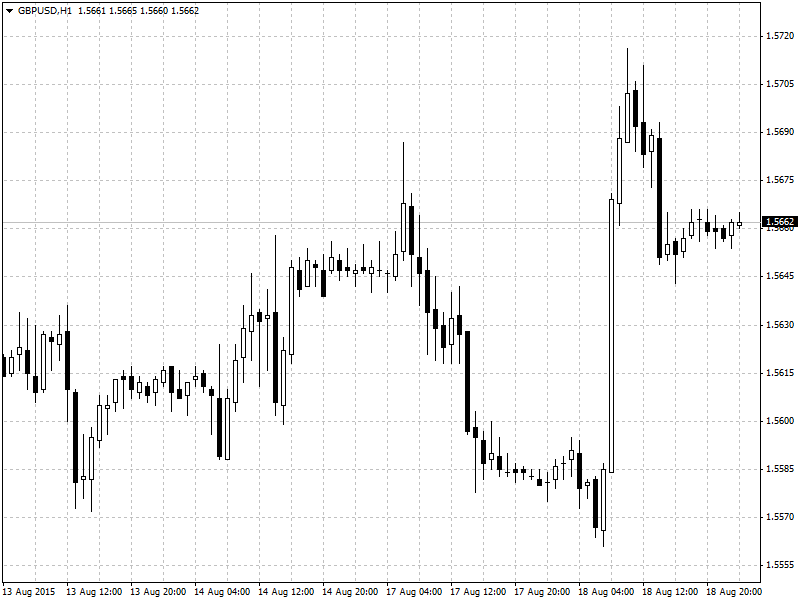

USD/JPY

The Japanese yen gained slightly in Asia on Wednesday, after trade data showed a better than expected gain in exports and a lesser sharp drop in imports - with investors looking ahead to Federal Reserve minutes later in the day. Japan's trade balance for July showed a deficit of ¥268 billion, wider than the ¥57 billion deficit seen. But exports made a surprise 7.6% gain in the month, year-on-year, compared to an expected 5.5% gain, while imports dropped 3.2%, less than the 7.9% fall seen.