Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

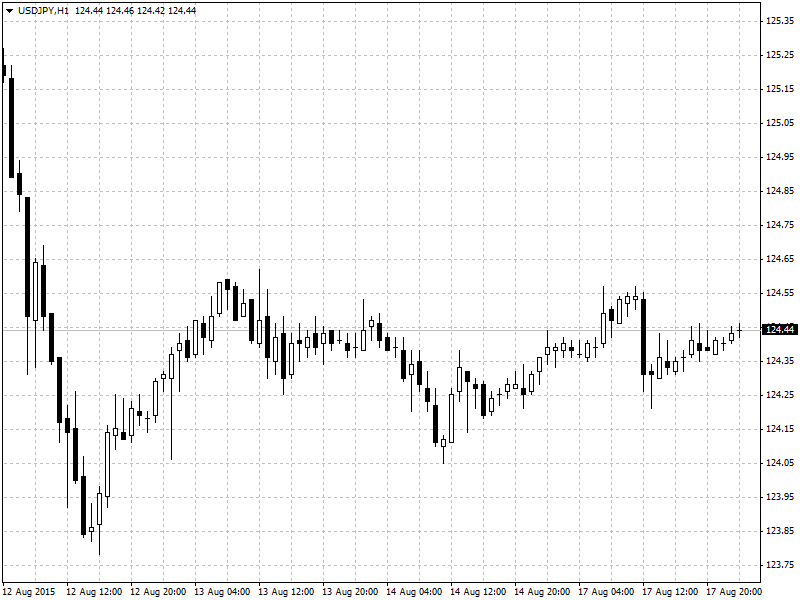

EUR/USD

Euro extended a mild losing streak to its fourth consecutive session, as currency traders await Wednesday's release of the minutes from the Federal Open Market Committee's July meeting for further indications on the timing of the U.S. Central Bank's first short-term interest rate hike in nearly a decade. The currency pair traded in a tight range between 1.1060 and 1.1125 before settling at 1.1078, down 0.0033 or 0.30% for the session. Although the euro closed lower against its American counterpart for the fourth consecutive trading day, it is still down by less than 1% during the minor losing streak. Previously, EUR/USD closed higher on six of its prior seven trading sessions, as it surged above 1.115 last Wednesday, its highest closing level in more than a month.

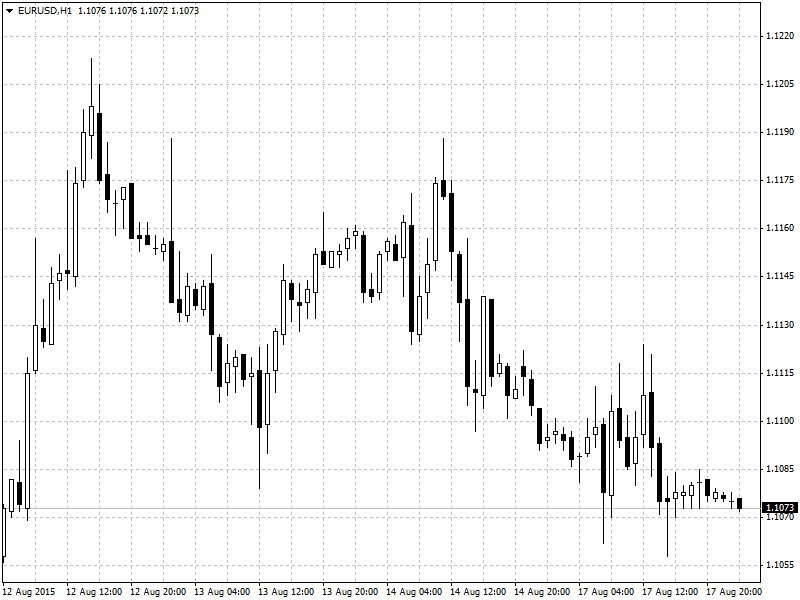

GBP/USD

Bank of England official Kristin Forbes has become the latest rate-setter to highlight the bank's central dilemma: how to square a strong domestic economy, which points to higher interest rates, with global disinflationary forces. Forbes sent the pound higher against the euro after she warned Britain's economic recovery could be damaged if the BoE waits too long before raising interest rates. She pointed to the strong momentum in the economy and improving wage data. But she also noted that sterling's strength, falling energy prices and the devaluation of China's yuan currency might dampen international inflation. While emphasizing that some of these factors might obscure rising underlying cost pressures in Britain, her comments were a reminder that the outlook for British monetary policy hinges to a large extent on global pressures.

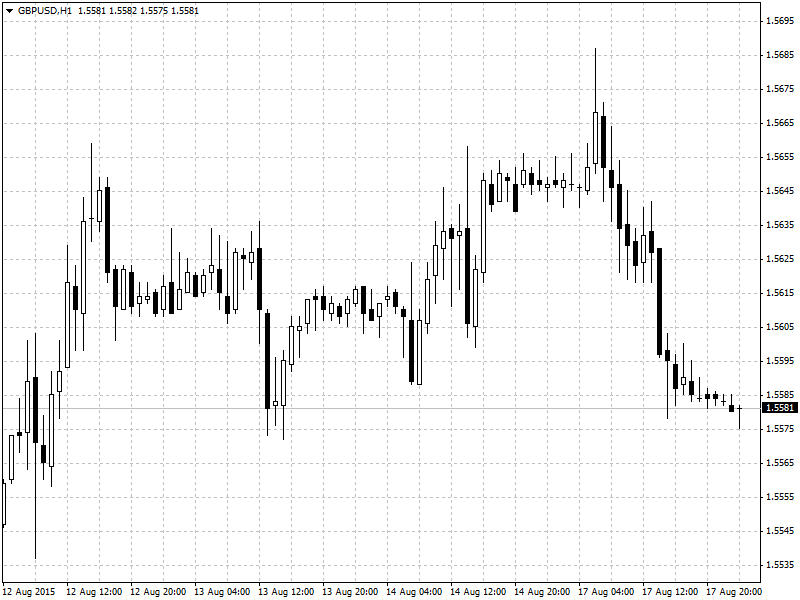

USD/JPY

The dollar edged higher against the other major currencies on Monday as investors remained wary in the wake of the yuan’s devaluation last week, while the yen shrugged off data showing a contraction in second quarter growth in Japan. Data on Monday showed that Japan’s gross domestic product contracted by 0.4% in the three months to June and was down 1.6% on a year-over-year basis. The contraction was slightly smaller than forecast, but concerns over the outlook for third quarter growth supported expectations for more monetary easing from the Bank of Japan.