Investing.com’s stocks of the week

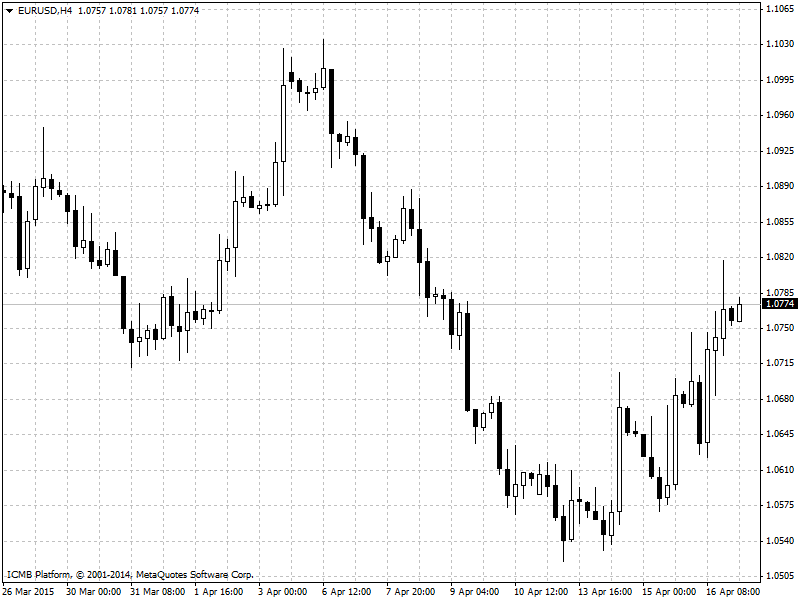

The euro gained ground against the broadly softer dollar on Thursday, but gains were held in check as euro area bond yields fell to fresh lows a day after the European Central Bank said it expects to fully implement its trillion euro easing program. The upside for the single currency looked likely to remain limited after ECB President Mario Draghi played down speculation that recent signs of a recovery in the euro zone economy could see the bank scale back its buying program. Draghi also played down concerns that the asset purchase program will struggle to find enough euro zone bonds to buy. The yield on German 10-year bonds fell to new lows on Thursday, while the French 30-year yield fell further below 1%. But the yield on Greek 10-year bonds jumped and the yield on 2-year also spiked higher amid sensitive concerns that Athens is no closer to reaching an agreement on economic reforms for bailout funds with its creditors, fueling fears that Greece could be forced out of the euro zone.

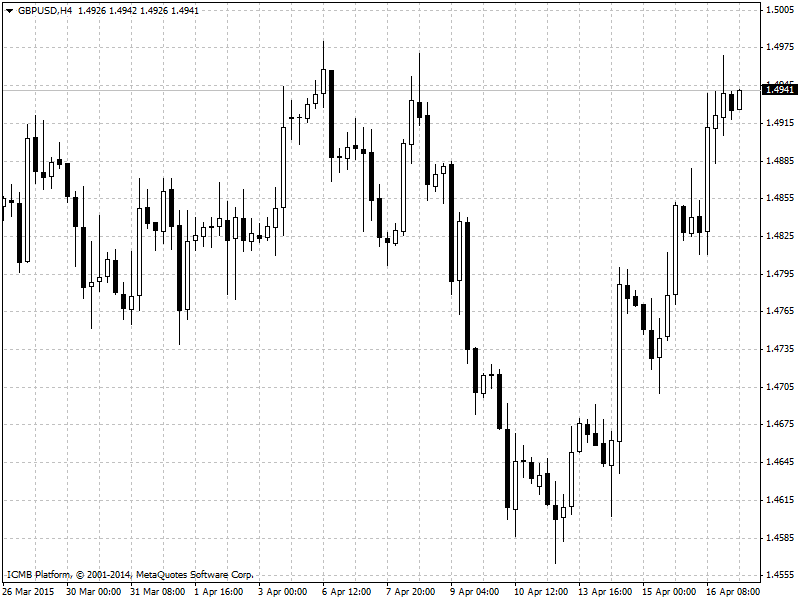

The pound was higher climbing 0.42% to 1.4905 on Thursday, as sentiment on the greenback remained vulnerable after the previous session's downbeat U.S. data and investors are focused on additional U.S. economic reports for building permits, unemployment claims and Philly fed manufacturing index.

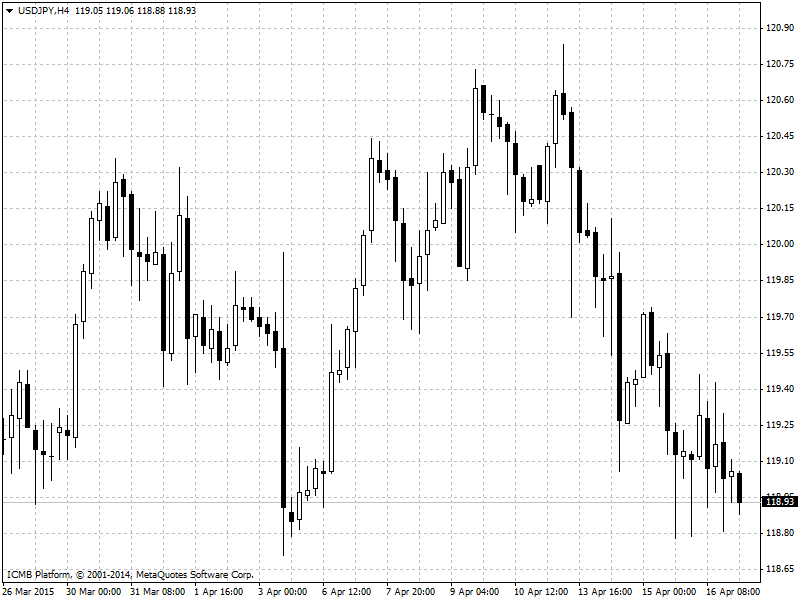

The dollar extended losses against the Japanese yen on Thursday, as the release of weak U.S. data fuelled further uncertainty over the strength of the economy and the timing of a rate hike. Meanwhile, the Treasury Department announced Thursday that Japan had concealed China as the largest foreign holder of U.S. government debt. At the end of February, Japan owned $1.2244 trillion in U.S. Treasuries, slightly above China's total of $1.2237 trillion in holdings.