Basic materials are the most boring of businesses. They include production of steel and aluminum and mining. Doesn’t that copper mine above look like a fun place to work? However, they are the backbone of society, and when these companies are doing well it is a good sign for the economy.

Tuesday marked an important day for basic materials in the stock market. The ETF that tracks this sector, Materials Select Sector SPDR (NYSE:XLB), confirmed a break out of a bottoming process after a pullback that began a year ago. The price of the ETF made a new 9-month high, moving up on a strong Marubozu candle.

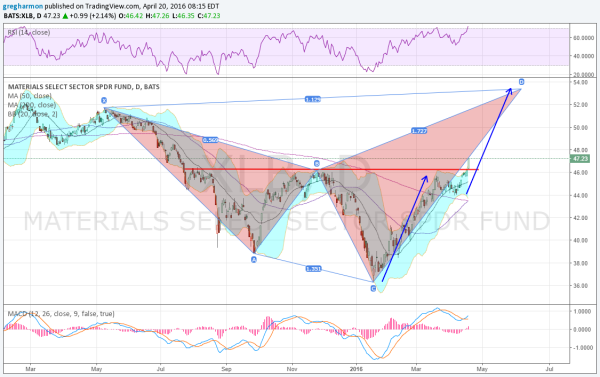

The chart above shows that move, as the Bollinger Bands® first squeezed and then opened for the explosion higher. The thrust took the price out of the Bollinger Bands, so there may be a need to consolidate before a further run, but there are plenty of good signs for the future in the chart.

The RSI is in the bullish zone, perhaps a bit overheated, but strong, while the MACD is crossing up and rising. Both momentum indicators support further upside. There is a bullish golden cross printing today as well with the 50-day SMA crossing up through the 200-day SMA.

How far will it run? We will need to wait and see, but there are two technical measures that suggest the ETF may build a 13% move higher. The break of the March consolidation gives a measured move higher to about 53.50. And the bearish shark harmonic pattern has a potential reversal zone right there as well at 53.40. Neither are a guarantee, but suggest it is time to build a position in basic materials in your portfolio.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.