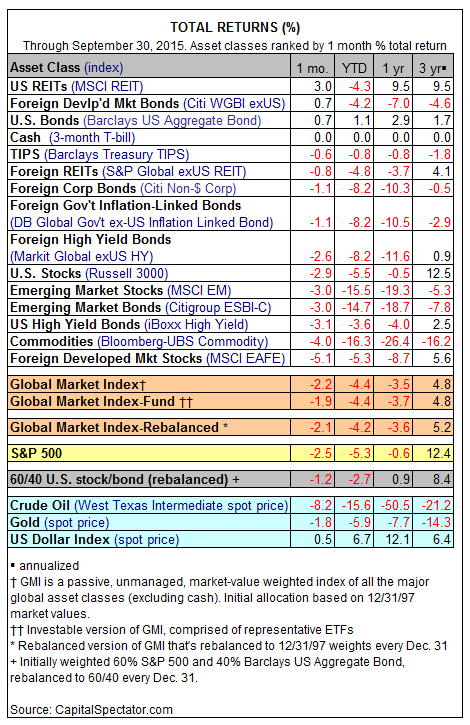

September was another rough month for most of the major asset classes. The main exception: US real estate investment trusts (REITs), which popped 3.0% last month (MSCI REIT Index). The safe haven of fixed income also provided some relief. Investment-grade bonds in the US and in foreign developed markets inched higher as renewed concerns about global growth convinced the crowd to load up on safe assets. Otherwise, red ink was the dominant theme as the third quarter stumbled to an end.

The big loser in September: foreign equities in developed markets, which tumbled 5.1% last month, based on the MSCI EAFE Index. Commodities weren’t far behind. The broadly defined Bloomberg Commodity Index shed 4% in September, leaving the benchmark lower by more than 16% this year through the end of Q3.

The bias for selling last month continued to take a toll on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI lost 2.2% in September, which pushed the year-to-date performance deeper into the red. The benchmark is now off by 4.4% this year through last month’s close.

GMI’s trailing 3-year total return is still in positive territory, posting a 4.8% annualized rise through September. But that’s less than half the 3-year gain from as recently as this past May. Meanwhile, the correction of late has closed the formerly wide gap between GMI’s trailing return and the modest risk premium forecasts for the index that have been a staple on these pages in recent history. For instance, last month’s long-run risk premium outlook for GMI anticipates a mild 3.4% annualized performance.