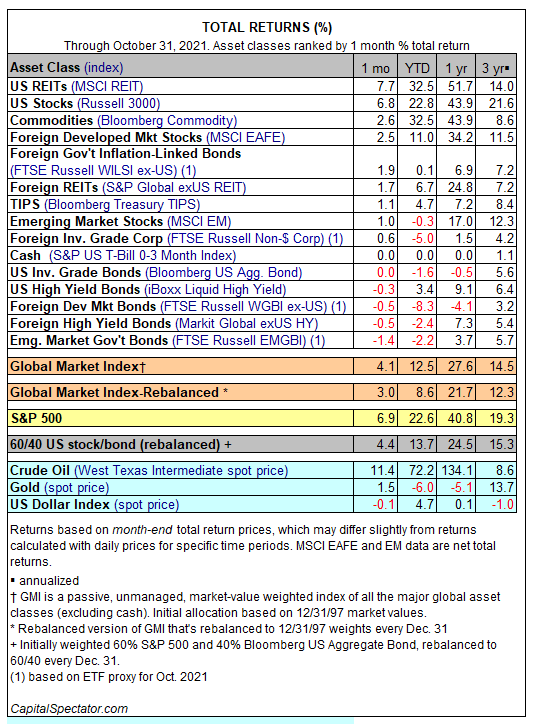

US real estate investment trusts (REITs) and stocks posted the strongest returns for the major asset classes in October—by wide margins.

US REITs surged 7.7% last month, reversing September’s sharp decline. The recovery puts American property shares in the lead for 2021 with a 23.5% total return, albeit just fractionally ahead of commodities.

US stocks were a close second in October. American equities rose 6.8%, based on the Russell 3000 Index. Year-to-date, US shares are up a strong 22.8%.

Foreign bonds were the losers in October. The deepest setback was in emerging-markets government bonds, which fell 1.4%—the worst performer for the major asset classes last month.

US bonds, by contrast, were essentially flat in October.

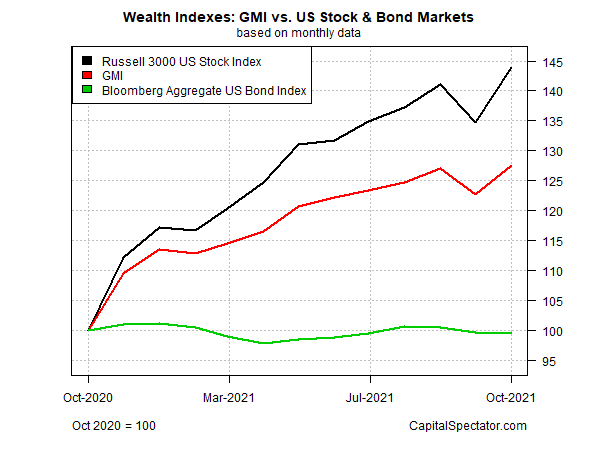

The Global Market Index (GMI) rebounded last month. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rallied 4.1%. The advance marks the strongest monthly gain in 11 months for the index. Year-to-date, GMI is up by a robust 12.5%.

Comparing GMI to US stocks and bonds still shows a strong middling performance over the trailing one-year period. GMI earned roughly 63% of the gain posted by US stocks over the past 12 months. US bonds, by contrast, continue to tread water for the trailing 12-month window.