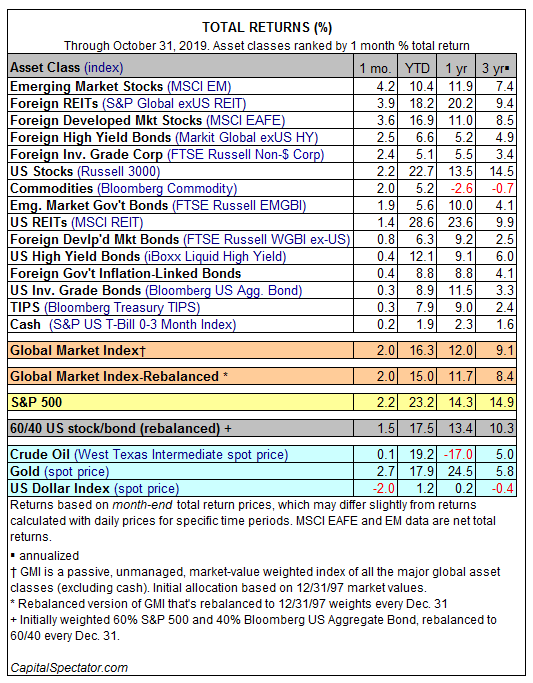

The old investing proverb that markets like to climb a wall of worry was reaffirmed in dramatic fashion last month. Indeed, all the major asset classes posted gains in October. In fact, the latest installment of across-the-board increases marks the third time so far this year that the crowd bid up prices in everything in a calendar month. (January and June also posted gains in every primary slice of the global markets.)

Leading the way higher last month: emerging markets stocks. The MSCI Emerging Markets Index surged 4.2% in October, it’s best monthly advance since June.

Non-US markets generally stole the show last month. The top-five performances in October were found beyond America’s shores.

The weakest performer: cash. The S&P US 0-3 Month T-Bill Index edged up 0.2% in October.

The perfect record for performance also applies to year-to-date results. Behold: everything is now enjoying a bullish tailwind in 2019 through October’s close. The top year-to-date performer: US real estate investment trusts (REITs). The MSCI REIT Index is ahead by a sizzling 28.6% on a total-return basis this year.

With no sign of red ink in the major asset classes in October (or in 2019 so far), it’s no surprise that the Global Market Index (GMI) is posting impressive results. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights rose 2.0% last month and is ahead by a strong 16.3% year to date.

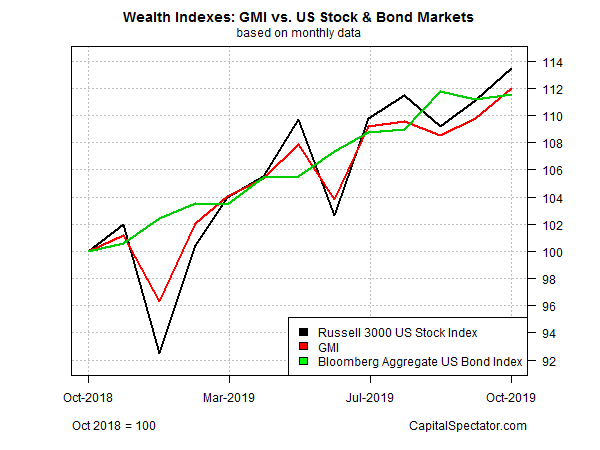

For a bit of perspective, consider trailing one-year results for GMI relative to US stocks and US bonds. GMI is up 12% over the past year (red line in chart below), or just behind US equities (NYSE:Russell 3000) and slightly ahead of US investment-grade fixed income (Bloomberg Aggregate US Bond Index). As broad-based trends for the usual suspects go, risk-takers are currently enjoying a bumper crop.