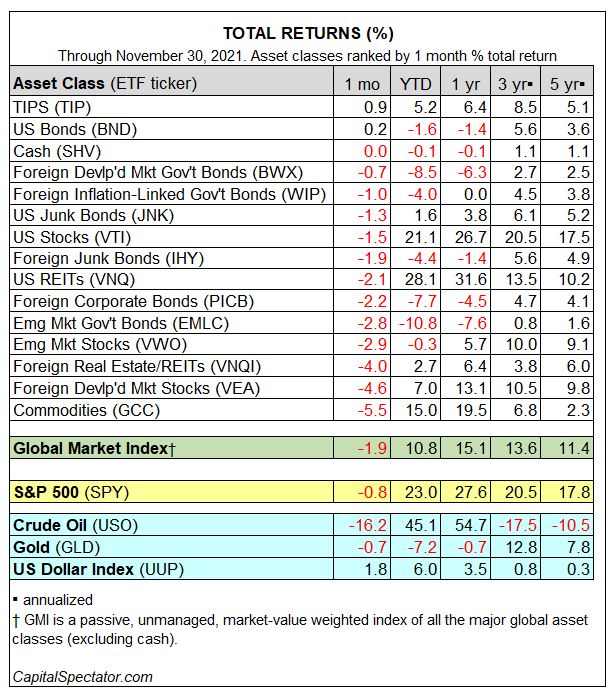

Red ink swept over monthly results for most of the major asset classes in November. The two exceptions: US investment-grade bonds and inflation-indexed Treasuries. Otherwise, losses dominated global markets last month, based on a set of proxy ETFs.

Inflation-indexed Treasuries via iShares TIPS Bond ETF (NYSE:TIP) topped the performance list in November with a 0.9% gain. A broad measure of US bonds via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) was in second place with a 0.2% return.

Elsewhere, losses held sway. The biggest setback: a broad measure of commodities—WisdomTree Continuous Commodity Index Fund (NYSE:GCC), which tumbled 5.5%.

The downside bias of late has pulled more asset classes into the red for year-to-date results. US real estate investment trusts—Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) and US stocks—Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI)—are the upside outliers, but gains for the year are becoming increasingly scarce across global markets as 2021’s close approaches.

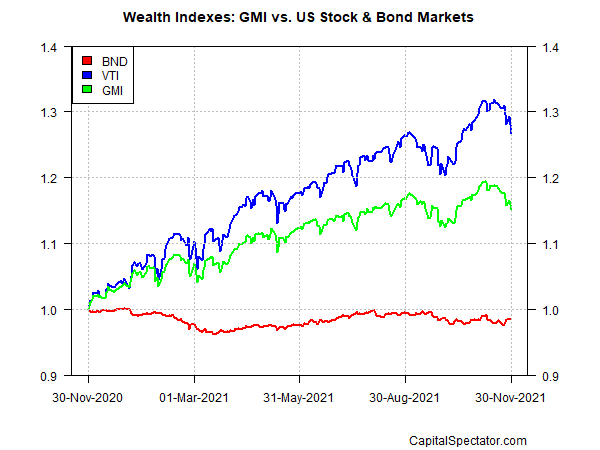

The Global Market Index (GMI) was caught in November’s correction. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, slumped 1.9% last month. Year-to-date, however, GMI is still comfortably in positive territory via a solid 10.8% increase.

Comparing GMI to US stocks and bonds still shows a strong middling performance over the trailing one-year period vs. a potent rally for US stocks (VTI) vs. a flat to slightly sliding performance for US bonds (BND) over the trailing 12-month window (252 trading days).