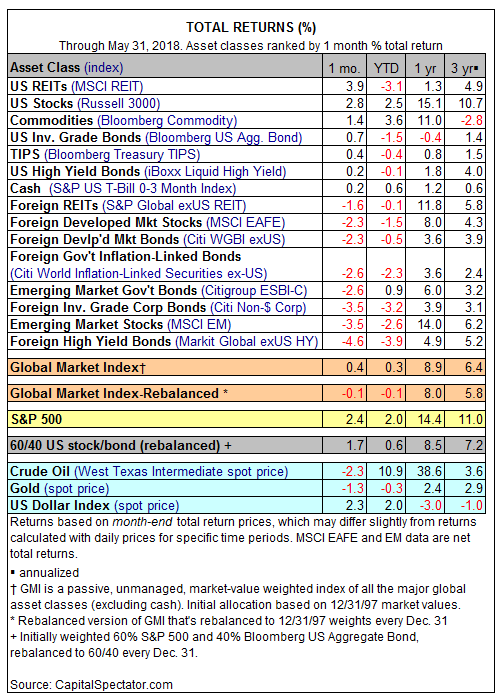

Real estate investment trusts (REITs) in the US continued to rebound in May, posting the strongest gain for the major asset classes last month.

The MSCI REIT index increased 3.9%, marking the third straight monthly gain. For the year to date, however, REITs are still underwater, shedding 3.1% so far in 2018 through last month’s close.

In contrast with positive returns for US assets, foreign markets fell in May (in unhedged US dollar terms). Foreign high-yield bonds in developed markets suffered the biggest decline for the major asset classes last month. The Markit Global Ex-US High Yield Index tumbled 4.6% in May – the second straight month of red ink for the index and its biggest monthly slide in more than three years.

Meanwhile, US stocks continued to bounce back after a sharp correction earlier in the year. The Russell 3000 Index popped 2.8% in May, the strongest monthly increase for the index since January.

US bonds also advanced last month. The Bloomberg-Barclays Aggregate Bond Index edged up 0.7% in May, nearly reversing the loss in the previous month.

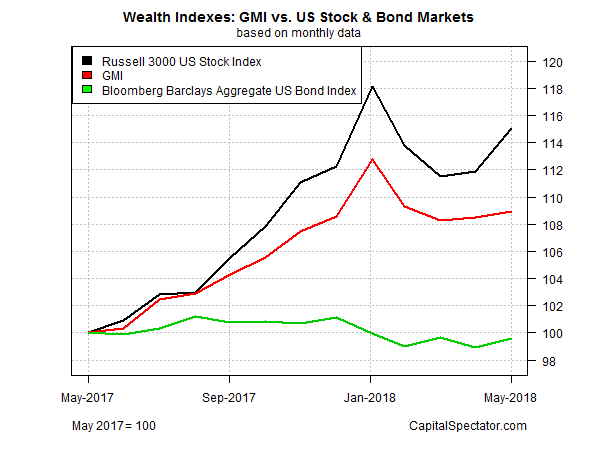

The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, posted its second consecutive monthly gain in May. The benchmark edged up 0.4% last month. For the trailing one-year period, GMI is ahead by a solid 8.9%. By comparison, US equities (Russell 3000) are enjoying a substantially stronger 15.1% over the past year while a broad measure of US investment-grade bonds (Bloomberg-Barclays Aggregate) is off 0.4% for the latest 12-month period.