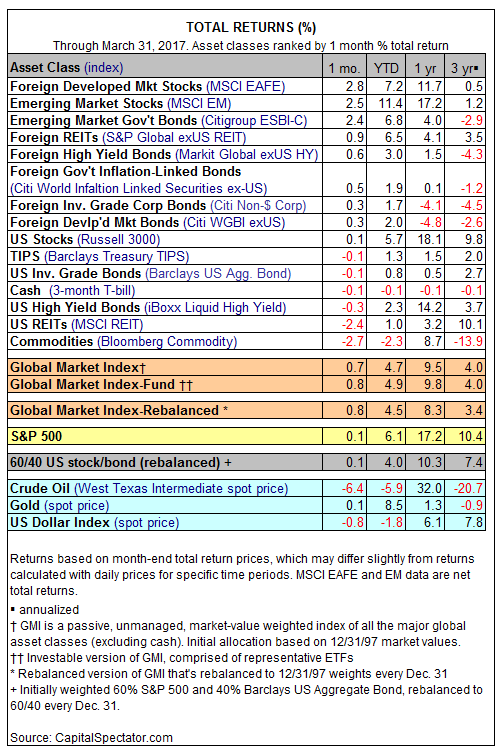

The value of international diversification was on display from a US perspective in March as foreign stocks and bonds topped the performance list for the major asset classes last month. Markets in the US were mixed: equities inched higher while bonds and real estate investment trusts retreated in the final month of the first quarter.

Foreign equities in developed markets grabbed the top spot in March with the MSCI EAFE Index posting a 2.8% total return. Emerging-markets stocks (MSCI EM) were a close second, advancing 2.5% last month.

Broadly defined commodities were in last place. Bloomberg Commodity Index slumped 2.7% in March – the first calendar-month decline since last October for the benchmark.

The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, posted its fourth consecutive monthly increase in March. GMI rose 0.7% last month, lifting the index to a 4.7% total return for this year’s first quarter.