The major asset classes enjoyed a flawless bull run in 2017, courtesy of across-the-board gains for all the broad measures of the global markets. Even cash managed to eke out a small gain.

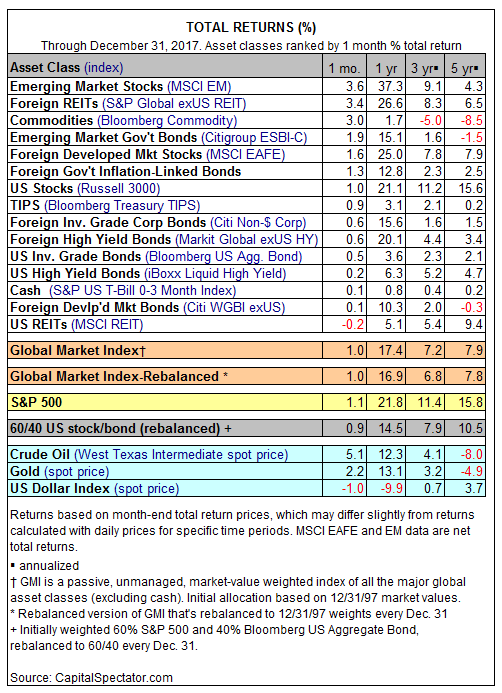

Leading the way higher: MSCI Emerging Markets Index, which posted a strong 37.3% total return in 2017 — by far the best increase among the major asset classes. The second-strongest rise was in foreign real estate/REITs via the S&P Global ex-REIT Index, which jumped 26.6%.

The US stock market had a good year in 2017 too. The Russell 3000 was up 21.1%, which ranks as the fourth-best return for the year just passed.

Cash delivered the weakest advance for the major asset classes last year: the S&P US Treasury Bill 0-3 Month Index edged up 0.8%.

The Global Market Index (GMI) closed the year with an impressive run. This unmanaged benchmark that holds all the major asset classes in market-value weights posted gains in every month for 2017. The bullish momentum lifted GMI by an impressive 17.4% last year — the sharpest advance in a single calendar year since 2003, when the benchmark surged 23%.