It’s official—2015 was a rotten year for the major asset classes. Other than a measly 2.5% total return in US real estate investment trusts (REITs) and fractional gains in US stocks and investment-grade bonds, the year just passed delivered black eyes to most of the broadly defined slices of the global asset pie. If you don’t mind a round of statistical abuse, let’s review the numbers.

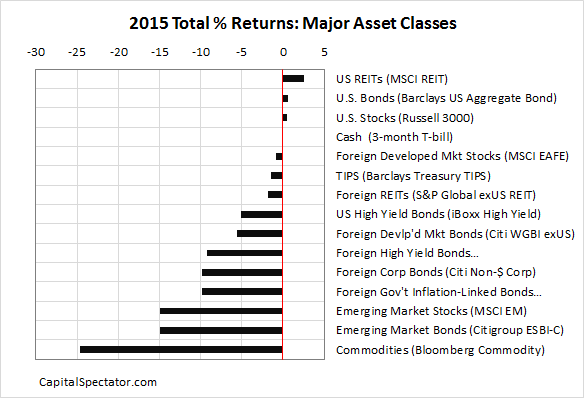

Here’s a graphical profile of returns for 2015. As you can see, the losses are widespread, varying from the sharp 25% tumble in broadly defined commodities to a slight setback for non-US stocks in developed markets (in US unhedged dollar terms).

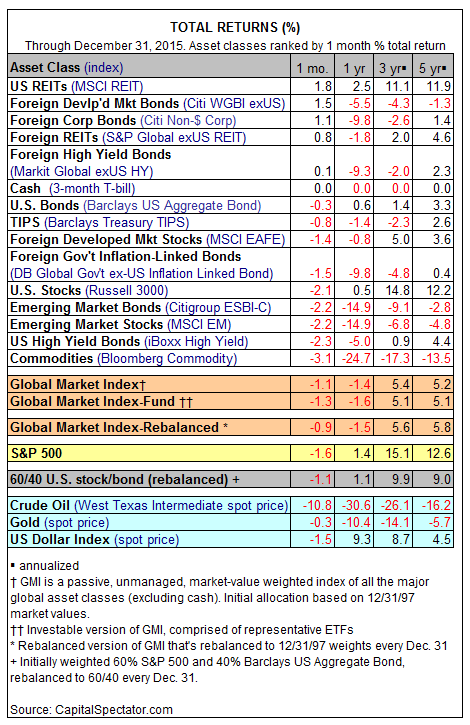

Here’s how the numbers stack up across a spectrum of trailing periods through Dec. 31, 2015.

Note the modest 1.4% loss last year for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The dip in 2015 for GMI suggests that most multi-asset-class strategies suffered in kind. Unless you were able to execute some fancy footwork on the tactical-asset-allocation dance floor, broadly diversified strategies probably delivered roughly flat to slightly negative results last year.

On a trailing 3- and 5-year basis GMI continues to post modest gains in the low-5% range. But that’s a substantial haircut from the returns we saw in 2014 and early 2015. Is GMI’s weak run of late a surprise? Perhaps not. The Capital Spectator’s long-run risk premia estimates for GMI throughout much of last year have been pointing to softer returns relative to recent history—see last month’s projections, for instance.

Will the year ahead deliver something better? For the moment, Mr. Market’s ex ante clues don’t look especially encouraging. But expected returns—and risk—vary through time, which is a reminder that a robust system for risk-management and analysis will probably be especially valuable in the year to come.

In any case, 2016 is set to commence with a fair amount of baggage held over from last year. Let the games begin!