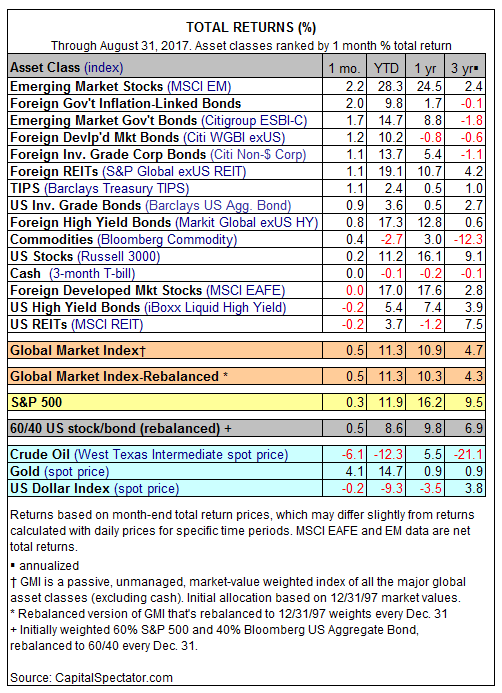

Another month, another bullish tailwind for most of the major asset classes. Nearly every corner of the global markets gained ground in August, led once again by stocks in emerging markets. The only losers last month: US junk bonds and real estate investment trusts (REITs), which posted fractional declines. Otherwise, performance was broadly positive.

For a second month in a row, MSCI Emerging Markets Index won the horse race. This slice of global equity markets added 2.2% in August – the ninth consecutive monthly gain for the benchmark. So far this year, this index up a sizzling 28.3%, which marks the strongest advance so far in 2017 for the major asset classes.

Meanwhile, last month’s bottom performer, US REITs, posted the first monthly loss since May as the MSCI REIT Index edged down 0.2% in August. Year to date, however, REITs are holding on to a modest 3.7% total return.

The upside bias for most asset classes continued to lift the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI inched up 0.5% in August. The index has posted a gain in every month since last December, although the latest increase is smallest this year. Year to date, however, GMI is ahead by a strong 11.3%.