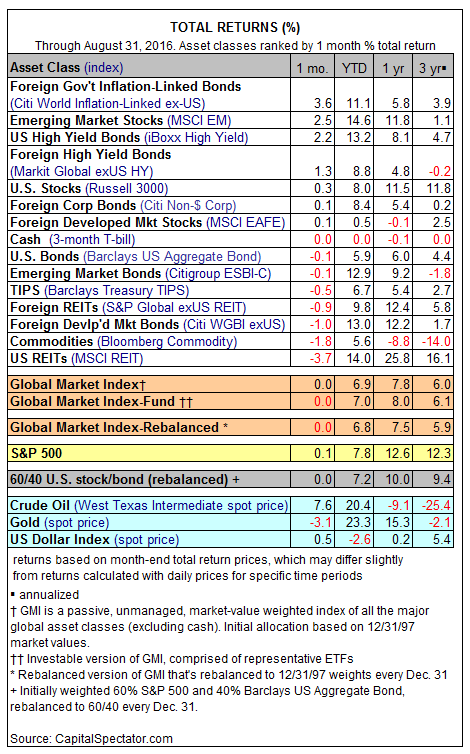

Inflation-linked bonds issued by foreign governments came alive in August, posting the strongest performance among the major asset classes. Last month’s hefty 3.6% total return for the Citi World Inflation-Linked Bond ex-US Index suggests a whiff of worry in the global markets on the subject of future pricing pressure for the global economy.

Misguided? Perhaps, given that disinflation and negative interest rates remain a conspicuous presence around the world. In any case, last month’s second-place return leader: emerging market stocks (MSCI EM), which generated a solid gain for the third month in a row.

On the losing end of the list last month: US real estate investment trusts (REITs). With the potential for another interest rate hike lurking by way of the Federal Reserve, the yield-sensitive REIT sector tumbled in August. MSCI REIT’s -3.7% slide marks the biggest monthly decline in a year for the index.

Returns overall were mixed last month. As a result, the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, was unchanged in August. Although the benchmark was flat, GMI has yet to post a monthly loss so far in 2016. For the year to date, GMI is up a respectable 6.9%.