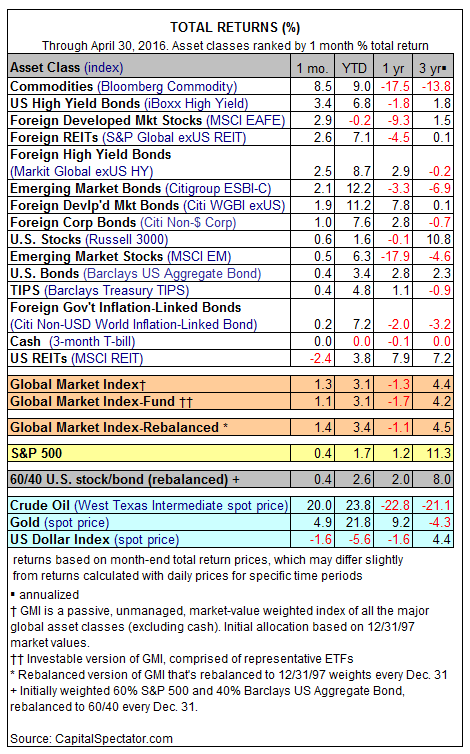

Global markets continued to rebound in April. Other than US REITs, which fell modestly in the kick-off to the second quarter, all the major asset classes posted gains last month, building on March’s strong rally. Leading the way: commodities broadly defined. The Bloomberg Commodity Index surged 8.5% in April, dispensing the biggest monthly increase in nearly six years. The snapback in commodity prices last month also marks the second monthly gain for raw materials—the first set of back-to-back monthly increases in two years.

The firmer pricing inspires some analysts to argue that the multi-year bear market for commodities has finally run its course. Perhaps; although skeptics counter that it’s not yet clear if the latest pop is the start of new bull market or just another bear-market rally that gives way to even lower prices down the road.

Meantime, red ink for the year-to-date column remains scarce for the second month in a row after April’s widespread gains. The lone exception is the fractional loss for equities in developed markets (MSCI EAFE). Otherwise, the rest of the field is sitting on gains for 2016 through the end of April.

The general upswing in prices last month lifted the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The benchmark climbed 1.3% in April, posting its third straight monthly gain. For the year so far, GMI is ahead 3.1%. The one-year return is still moderately under water, although GMI’s trailing three-year annualized performance held above 4% for the second month in a row. That’s still close to the weakest three-year rolling return for GMI in several years, but for the moment the historical trend is on the mend.