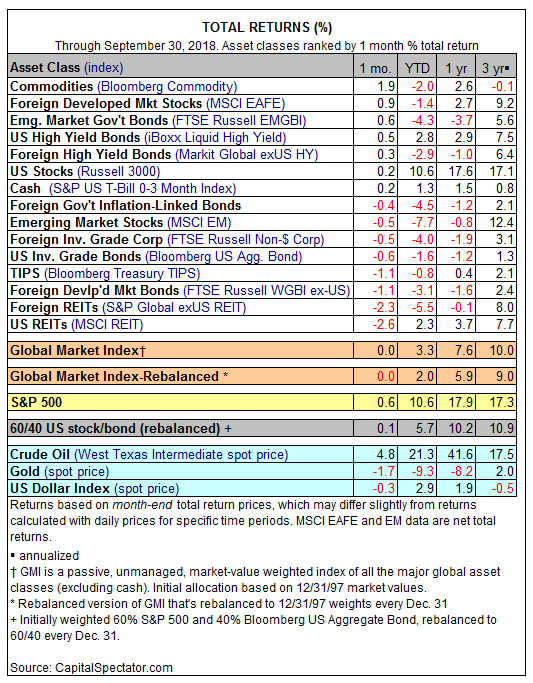

Broadly defined commodities led the performance horse race in September for the major asset classes. The return marked the first monthly advance for commodities since May, which was also the last time that raw materials writ large led the field.

The Bloomberg Commodity Index jumped 1.9% last month, comfortably above the other gains for the major asset classes. The second-biggest increase in September was posted by foreign stocks in developed markets: the MSCI EAFE Index gained 0.9% last month.

US real estate investment trusts (REITs) suffered the biggest loss in September among the major asset classes. The MSCI US REIT Index tumbled 2.6% — the first monthly setback for US securitized real estate since February.

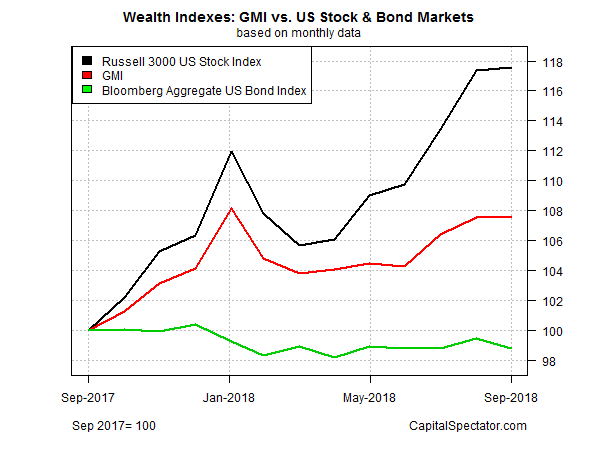

The broad trend for assets overall was flat in September, based on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI was unchanged in September. For the past year, however, GMI is ahead by a solid 7.6%.

Meantime, US stocks edged up 0.2% in September via the Russell 3000 Index, and for the trailing one-year window equities surged a strong 17.6%.

It’s another story for domestic fixed-income securities, courtesy of rising interest rates. US investment-grade bonds (via Bloomberg US Aggregate Bond) slumped in September, falling 0.6%. For the past 12 months, US bonds remain in the red with a 1.2% loss vs. the year-earlier level.