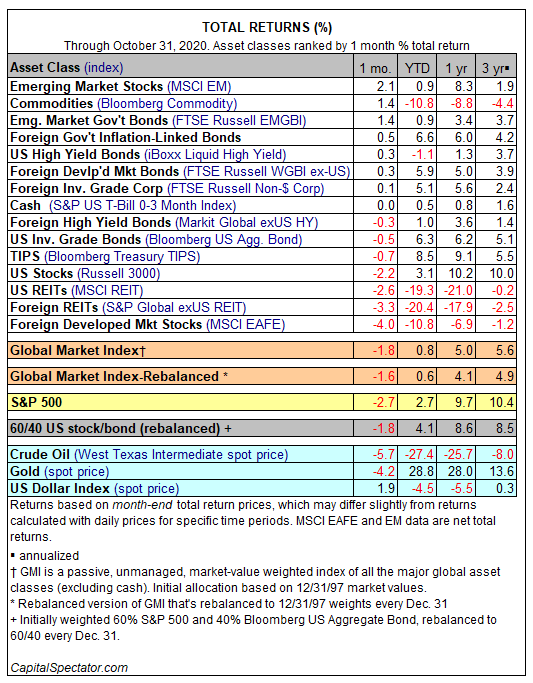

Global markets were mixed in October, with performances led by stocks and bonds in emerging markets, along with broadly defined commodities. The biggest losers for the major asset classes: shares in the US and developed markets and real estate shares around the world.

The clear winner last month: stocks in emerging markets via MSCI Emerging Markets Index, which posted a 2.1% return following September’s decline. Emerging-markets fixed-income was the third strongest performer for the major asset classes in October: FTSE Russell EM Government Bond Index rallied 1.4%.

For the year to date column, markets are reporting a wide range of returns. The strongest gain so far in 2020 is for inflation-indexed US government bonds. The Bloomberg US Treasury Inflation-Linked Index posted an 8.5% total return for the year through October 31.

That’s a long way from the deepest shade of red ink for year-to-date results via foreign property shares. The S&P Global ex-US Property Index is down a hefty 20.4% through last month’s close. US real estate investment trusts are the year’s second-worst performer: MSCI US REIT Index has lost 19.3% so far in 2020 on a total-return basis.

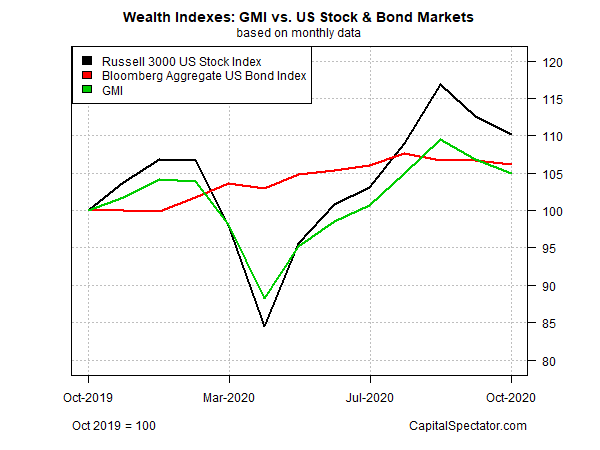

The Global Market Index (GMI) also lost ground last month. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, fell 1.8% in October. The setback marks the second straight monthly decline for GMI.

For the trailing one-year window, on the other hand, GMI continues to post a respectable 5.0% gain. That’s well below the 10.2% one-year total return for US stocks (Russell 3000) and modestly behind US investment-grade bond market’s 6.2% gain, based on the Bloomberg US Aggregate Bond Index.