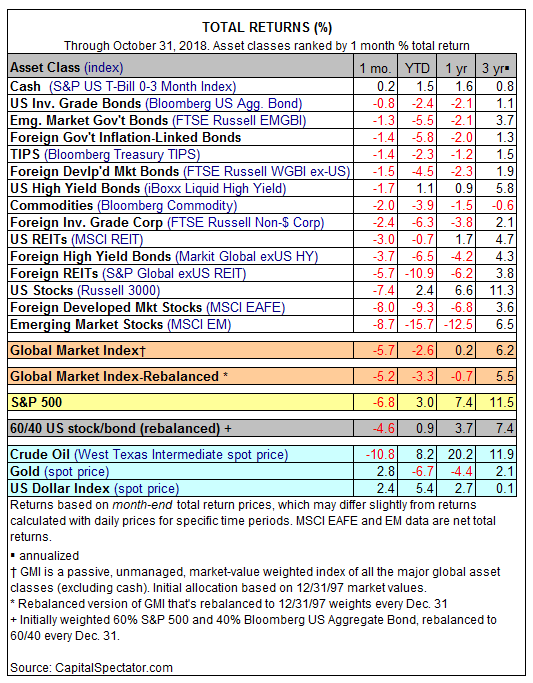

There was almost no place to hide in October. Except for cash, all the major asset classes lost ground last month, marking the first across-the-board setback since February’s widspread declines.

Stocks in the US and around the world posted the biggest losses, led a hefty setback in emerging market equities. The MSCI Emerging Markets Index tumbled 8.7% in October, the biggest monthly slide for the benchmark in over three years. Foreign stocks in developed markets and US equities were also down sharply last month, posting the second- and third-biggest declines, respectively, in October.

Cash topped the winner’s list at the start of the fourth quarter. The S&P T-Bill 0-3 Month Index edged up 0.2% in October, dispensing the only gain last month for the major asset classes.

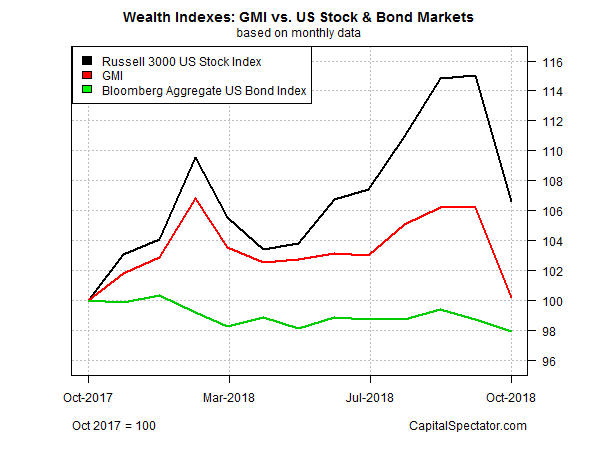

Not surprisingly, the broad trend for assets overall was negative. The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, tumbled 5.7% last month – the biggest monthly setback in nine years! For the trailing one-year window, GMI is still holding on to a fractional 0.2% gain.

Last month’s hair cut took a heavy toll on US stocks, but over the one-year period the Russell 3000 index earned a respectable 6.6% total return through October. A broad measure of investment-grade US fixed income securities, on the other hand, is under water over the past 12 months: the total return for Bloomberg US Aggregate Bond is in the red by 2.1% for one-year results.