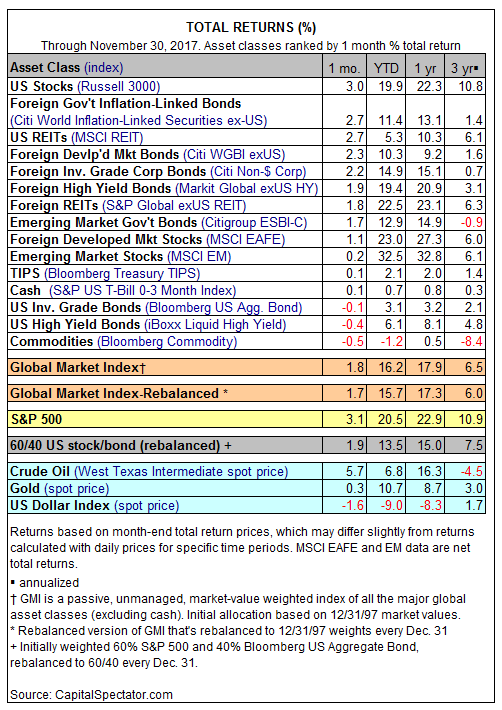

US stocks resumed the lead in November as the top performer for the major asset classes. The Russell 3000 Index gained 3.0% last month, the strongest advance since February and the 13th consecutive month of positive total returns for the benchmark.

Most asset classes posted gains in November, with only a handful of exceptions. The red ink was mild and limited to US investment-grade and junk bonds and broadly defined commodities, last month’s worst performer. The Bloomberg Commodity Index ticked down 0.5% after rising 2.1% in October.

Meantime, the tailwind continued to blow for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The index posted a 1.8% total return for November (the 12th straight monthly increase) and is up a sizzling 16.2% year to date. The monthly winning streak through November marks the longest run of monthly gains in GMI’s 20-year history, edging out the previous record – an 11-month marathon in 2006-2007.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.