Major Asset Classes | May 2019 | Performance Review

Stocks around the world took a hit in May as trade-related fears weighed on the outlook for the global economy. The deterioration in sentiment was a boon for US bonds, which attracted a surge of asset flows in the rush for a safe haven last month.

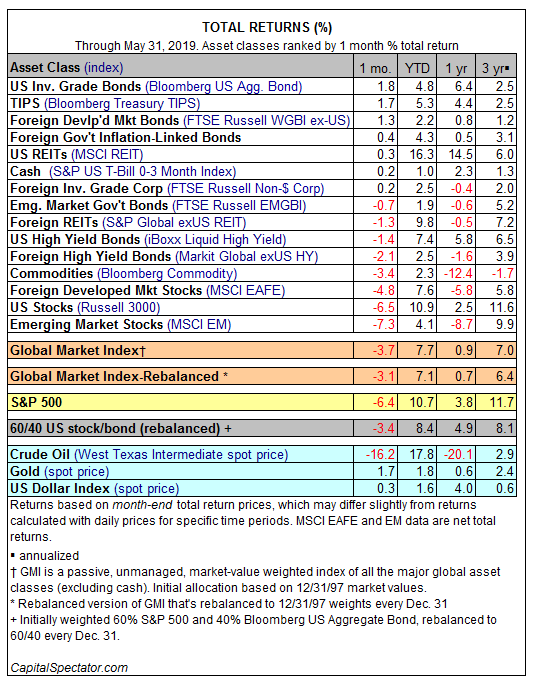

May’s biggest loser for the major asset classes: stocks in emerging markets. The MSCI Emerging Markets Index tumbled 7.3%. The sharp decline marks the index’s first monthly setback this year and the deepest loss since October.

US equities posted the first monthly decline this year. The Russell 3000 fell 6.5%, the steepest loss for the index since December’s 9.3% slide.

US bonds benefited from last month’s risk-off sentiment. The biggest winner in May for the major asset classes: Bloomberg US Aggregate Bond Index, a broad measure of investment-grade bonds in the US. The 1.8% return is the benchmark’s third straight monthly increase.

On a year-to-date basis, US real estate investment trusts (REITs) are leading the field by a wide margin. The MSCI REIT is up a sizzling 16.3% on a total return basis in 2019 through May 31, well ahead of the second-best performer: US equities via the Russell 3000’s 10.9% year-to-date gain.

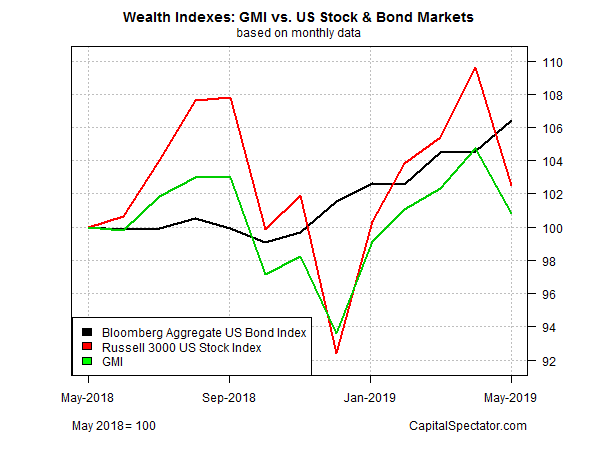

Meanwhile, the sharp reversal in the price of most risk assets last month cut the Global Market Index in May by an unusually hefty degree. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights fell 3.7% — GMI’s first monthly decline in 2019 and the deepest loss since last December.

On a trailing one-year basis, GMI is still posting a slight gain, rising 0.9% through last month’s close. The benchmark’s fractional gain trails the one-year performances for US stocks (Russell 3000) and US bonds (Bloomberg Aggregate Bond) through the end of May.