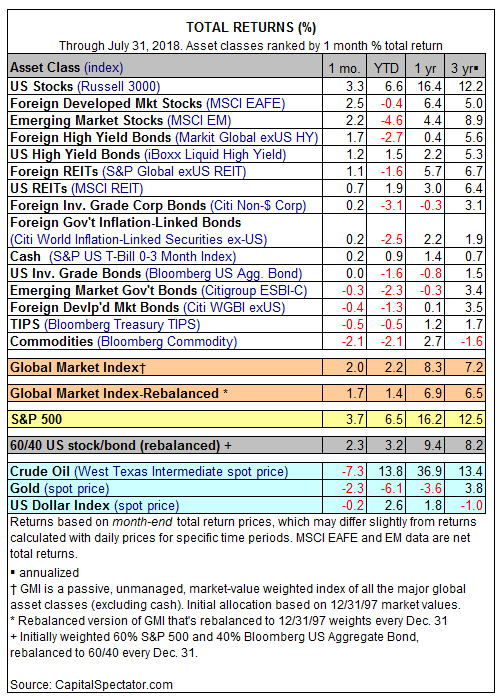

The US stock market topped the performance list for the major asset classes in July. The gain marked the fourth straight monthly advance and the strongest since January.

The Russell 3000 index rose 3.3% last month, comfortably above the rest of the field. The second-best performer in July: stocks in foreign developed markets via the MSCI EAFE, which posted a 2.5% increase.

The biggest loser in July: broadly defined commodities. The Bloomberg Commodity Index retreated 2.1%, the second consecutive monthly decline for this benchmark.

United States 10-Year eked out a fractional gain. The Bloomberg Global Aggregate Bond Index ticked higher by 0.02% in July, which followed a 0.1% loss in the previous month.

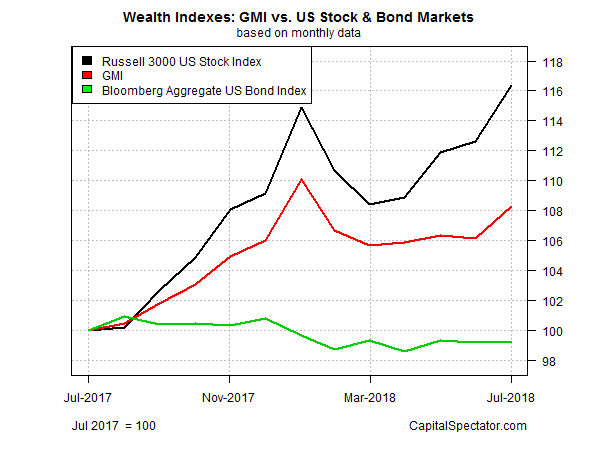

The generally positive tailwind in July lifted the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. After a mild 0.2% setback in June, GMI rebounded last month with a strong 2.0% gain – the biggest monthly increase for the index since January. For the trailing one-year window, GMI is up a solid 8.3%.

By comparison, US equities (Russell 3000) are up a substantially stronger 16.4% over the past year while the US investment-grade bond market (Bloomberg US Aggregate Bond) edged lower by 0.8% through July vs. the year-ago level.