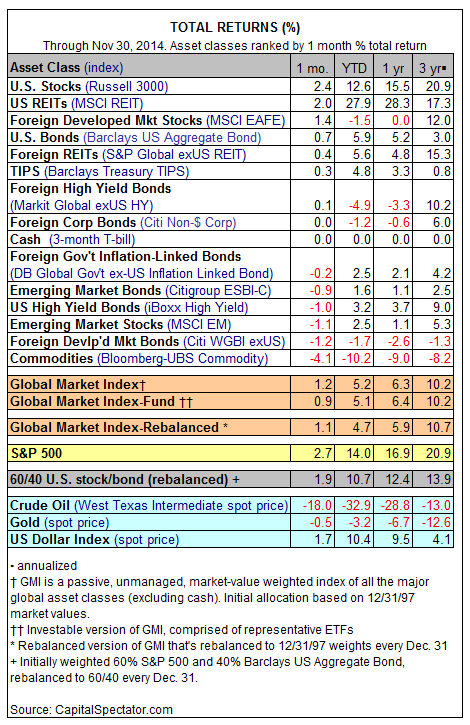

US equities (Russell 3000) took the lead with performance among the major asset classes in November, posting a solid 2.4% total return. US real estate investment trusts (REITs) were in close pursuit with a 2.0% advance, which builds on October’s spectacular 10.0% surge, based on the MSCI REIT Index. In third place: foreign stock markets in the developed world (MSCI EAFE), which dispensed a respectable 1.4% total return. Whatever macro troubles weigh on Europe and Japan (and there are many), the burden appeared to be in remission in November in terms of equity performance overall.

Turning to the losers, commodities broadly defined led the red-ink brigade last month with an unusually steep 4.1% loss, based on the Bloomberg-UBS Commodity Index. Quite a lot of the decline was due to crude oil’s dramatic 18.0% slide in November.

As for the Global Market Index (an unmanaged benchmark that holds all the major asset classes in market-value weights), this passive benchmark gained 1.2% in November. On a year-to-date basis, GMI is ahead by a moderate 5.2%. Short of an extraordinary burst of bullish momentum in December, GMI’s on track to dispense a substantially lesser calendar-year gain for 2014 vs. 2013’s impressive 14.2% rise.