We are often asked about the apparent disconnect between happenings on Main Street versus Wall Street. Investors notice markets running in one direction, while business owners notice things going in another. So, who has the right perspective? In this blog, we explore the relationship between economic growth and Standard & Poor’s operating earnings to develop a framework for connecting the dots between the two streets. We then address the “vibecession” phenomenon.

Returning to Normal

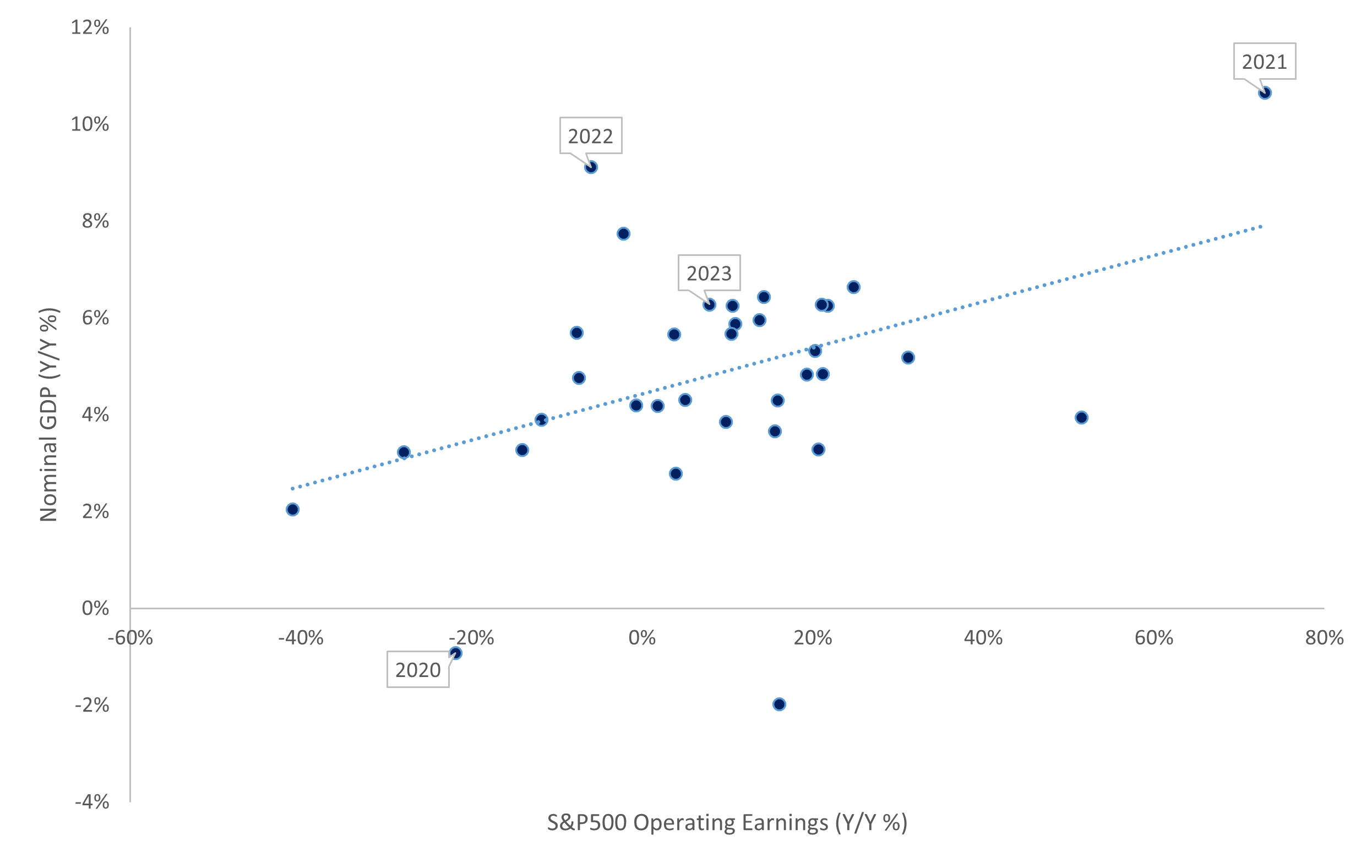

Growth in both the economy and company operating earnings are positively correlated, as illustrated in the chart below. The government shutdowns and subsequent reopenings shocked the relationship in recent years, but after this period of abnormality, we should expect a tighter link to emerge between these two variables by the end of this year.

We Expect Things to Return to "More Normal" by End of Year

Source: LPL Research, Bureau of Economic Analysis, Standard and Poors 05/22/24

The macro setup implies that nominal economic growth will likely soon be under 4.5% as labor demand and disposable income growth are set to slow later this year. We have already seen payroll growth moderate a bit, and fewer hours worked implies business activity is slowing down from its breakneck speed. As nominal growth slows, we expect operating earnings growth to also slow but stay positive.

Why the Different Perspectives?

The periodic opposing perspectives between Main Street and Wall Street often boil down to the different perspectives on inflation.

Businesses struggling with a lack of qualified job applicants and rising input costs, along with consumers paying more for less, created a “vibecession” with all of this happening as stocks kept hitting all-time highs.

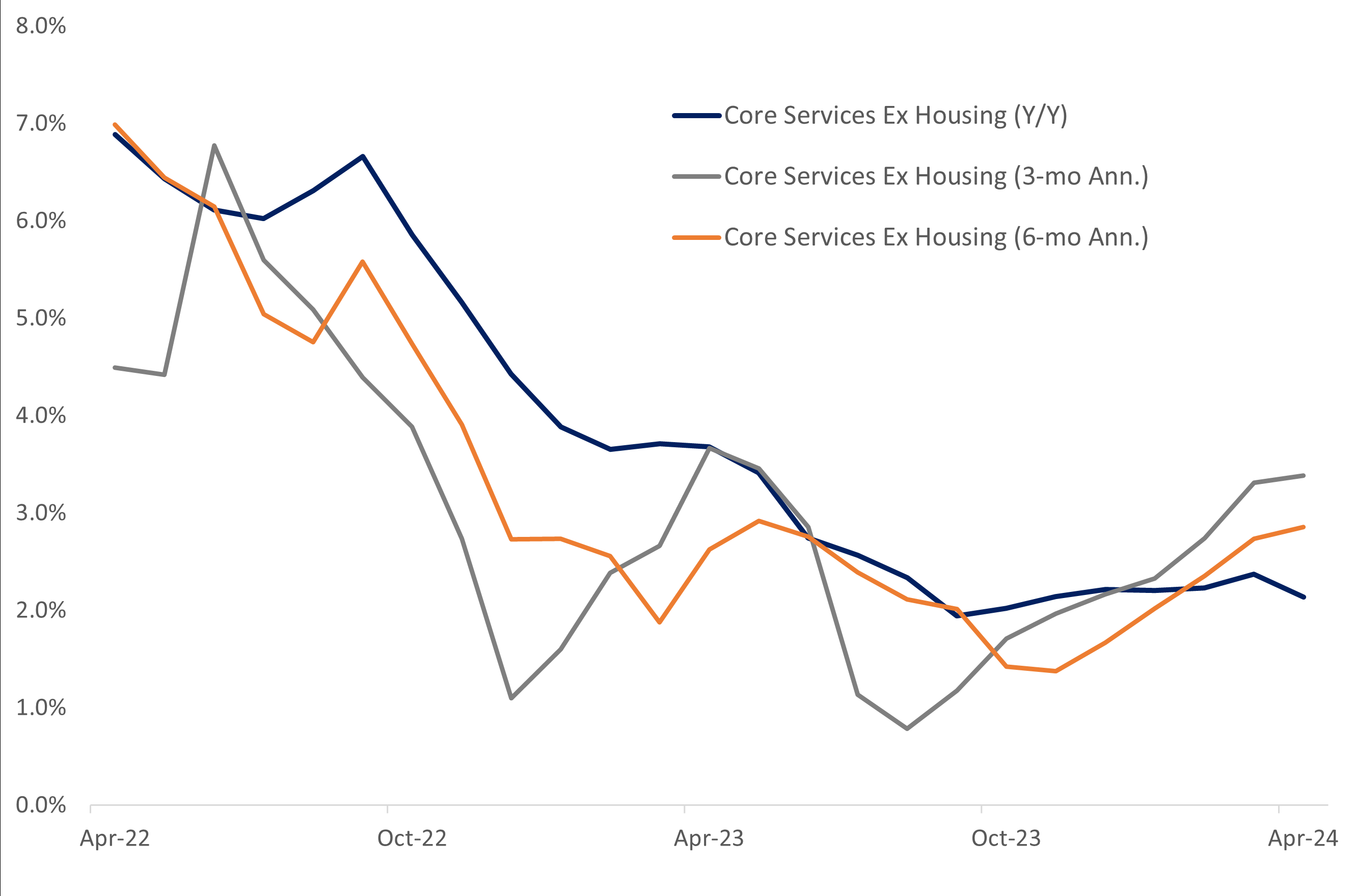

Sticky Services Inflation Turned a Corner

Source: LPL Research, Bureau of Economic Analysis 05/16/24

We think inflation will further ease this year, despite the risk in the coming months of base effects keeping some of the monthly readings a bit hotter than normal. However, last week’s Consumer Price Index (CPI) release likely illustrates inflation did not develop a new trend at the beginning of the year but rather, the hot prints were an anomaly as items such as insurance were repriced.

Running in Parallel

To keep the analogy going, you could say Main Street and Wall Street run in parallel. They do not intersect, and they certainly are not synonyms for the same road.

Both streets, if you will, rely on each other. Financial markets need to run smoothly for businesses to access capital, and businesses need to run profitably and credibly to earn investors’ attention. So, if our destination is a flourishing economy, Wall Street needs Main Street and Main Street needs Wall Street as they both serve separate but parallel functions.

Where do we go from here? In a slowing economy where consumers are starting to pull back on spending, it makes sense to be careful with stocks in the retail sector — as Target (NYSE:TGT) suggested in its cautious commentary accompanying its earnings release this morning. That may put more reliance on more business investment-driven areas of the market such as technology and industrials if the broad indexes are going to add to recent strength.

If U.S. equities slow down, market participants may turn to other geographies for opportunities. LPL Research remains neutral on developed international equities. Within international, the outlook for Japan continues to remain positive as the country emerges from its decades-long battle against deflation yet accommodative monetary policy. Better recent performance in Europe is encouraging as economic growth has shown signs of bottoming in recent weeks as the U.S. dollar rally has paused. China still seems like an interesting short-term trade, while India’s recent weakness could offer an attractive entry point, although we maintain a cautious stance overall on emerging market equities.

Finally, commodities could benefit from this period of sticky inflation, especially while we have supply and demand imbalances.

IMPORTANT DISCLOSURES: This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.