It has a Fundamental Analysis Score of 81 and a CapitalCube Implied Price of INR 241.05.

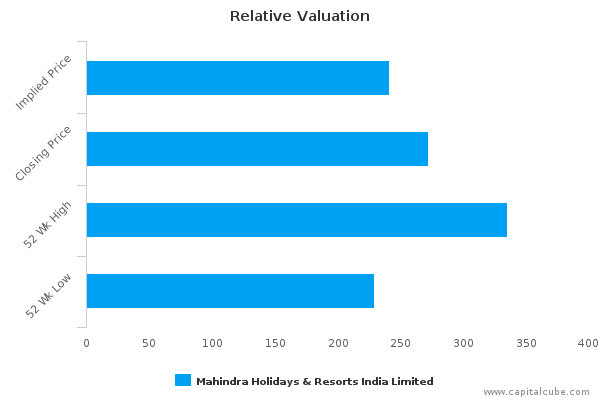

Relative Valuation

Mahindra Holidays & Resorts' (NSE:MAHH) price of INR 271.90 is greater than CapitalCube's implied price of INR 241.05. At this level, CapitalCube believes that Mahindra Holidays & Resorts India Limited is overvalued. Over the last 52 week period, the stock has fluctuated between INR 229 and INR 335.

Company Overview

- Relative underperformance over the last year is in contrast with the more recent outperformance.

- Mahindra Holidays & Resorts India Limited currently trades at a higher Price/Book ratio (3.06) than its peer median (1.36).

- We classify 533088-IN as Harvesting because of the market's relatively low growth expectations despite its relatively high returns.

- 533088-IN has relatively high profit margins while operating with median asset turns.

- Compared with its chosen peers, changes in the company's annual earnings are better than the changes in its revenue, implying better than median cost control and/or some economies of scale.

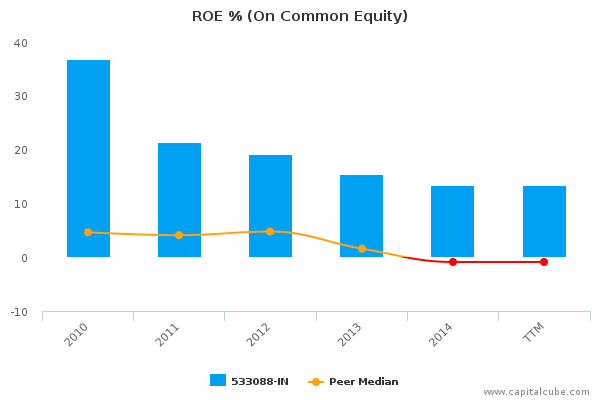

- 533088-IN‘s return on assets currently and over the past five years suggest that its relatively high operating returns are sustainable.

- The company's relatively high gross and pre-tax margins suggest a differentiated product portfolio and tight control on operating costs relative to peers.

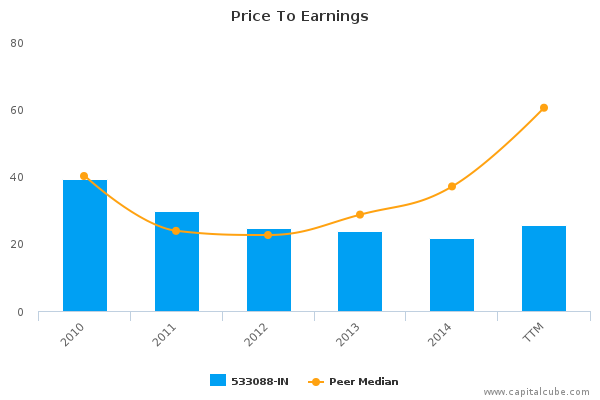

- While 533088-IN‘s revenue growth in recent years has been above the peer median, the stock's PE ratio is less than the peer median suggesting that the company's earnings may be peaking and the market expects a decline in its growth expectations.

- The company's level of capital investment seems appropriate to support the company's growth.

- 533088-IN has the financial and operating capacity to borrow quickly.

Investment Outlook

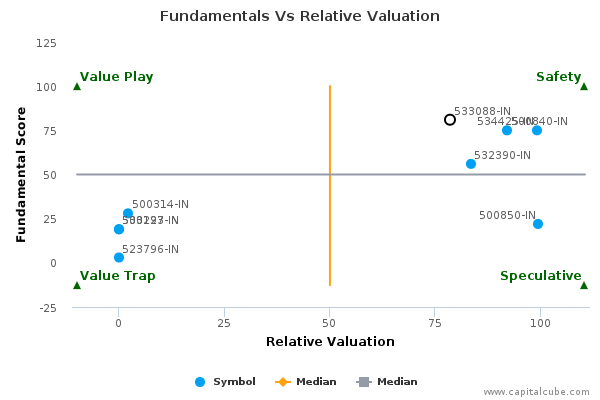

Mahindra Holidays & Resorts India Limited has a fundamental score of 81 and has a relative valuation of OVERVALUED.

Mahindra Holidays & Resorts India Limited appears on the top right hand quadrant of CapitalCube's Value – Price Matrix. We classify this as ‘Safety'. In other words, Mahindra Holidays & Resorts India Limited has a relatively high Fundamental Analysis score of 81, while being potentially overvalued and trading higher than its CapitalCube Implied Price of 241.05. There might be some safety in this stock where it's fundamental strength perhaps justifies its relatively higher price.

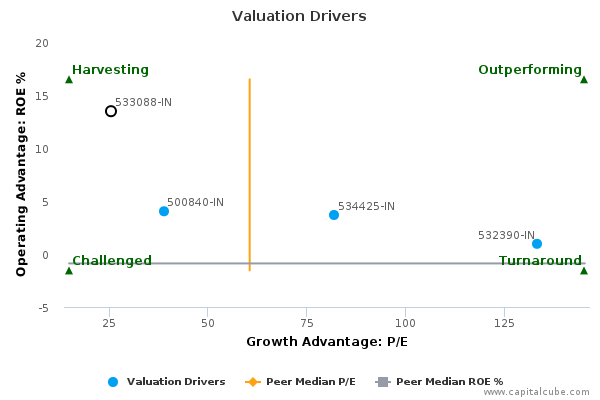

Drivers of Valuation

533088-IN has a Harvesting profile relative to its peers.

We classify 533088-IN as Harvesting because of the market's low expectations of growth (PE of 25.54 compared to peer median of 60.45) despite its relatively high returns (ROE of 13.47% compared to the peer median ROE of -0.89%).

The company currently trades at a higher Price/Book ratio of 3.06 compared to its peer median of 1.36.

533088-IN has moved to an Harvesting from a relatively high ROE profile at the prior year-end.

Peer Analysis

A complete list of valuation metrics is available on the company page.

Company Profile

Mahindra Holidays & Resorts India Ltd. engages in the business of leisure hospitality services. It operates through its resorts and sells vacation ownership and provides holiday facilities. The company is a part of infrastructure sector of the Mahindra group. Its resorts also offers furnished accommodation such as apartments, cottages, resort amenities, restaurants, ayurvedic spas, kids clubs and other holiday activities. The company operates through one business segment: Sale of Vacation Ownership. Mahindra Holidays & Resorts India was founded on September 20, 1996 and is headquartered in Mumbai, India.

Disclaimer

The information presented in this report has been obtained from sources deemed to be reliable, but AnalytixInsight does not make any representation about the accuracy, completeness, or timeliness of this information. This report was produced by AnalytixInsight for informational purposes only and nothing contained herein should be construed as an offer to buy or sell or as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only as of the date that it was published and the opinions, estimates, ratings and other information may change without notice or publication. Past performance is no guarantee of future results. Prior to making an investment or other financial decision, please consult with your financial, legal and tax advisors. AnalytixInsight shall not be liable for any party's use of this report.

AnalytixInsight is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security referred to herein. One of the principal tenets for us at AnalytixInsight is that the best person to handle your finances is you. By your use of our services or by reading any our reports, you're agreeing that you bear responsibility for your own investment research and investment decisions. You also agree that AnalytixInsight, its directors, its employees, and its agents will not be liable for any investment decision made or action taken by you and others based on news, information, opinion, or any other material generated by us and/or published through our services. For a complete copy of our disclaimer, please visit our website www.analytixinsight.com.