One of the largest automotive suppliers Magna International Inc. (NYSE:MGA) reported that it will exhibit its key products for the development of electrified and autonomous vehicles at the Consumer Electronics Show (CES) 2018, scheduled between Jan 9 and Jan 12. Its advanced product line will include solutions for electrification, autonomy and mobility.

Attendees at the Magna booth can experience a close, interactive view of the car through virtual reality technology, which will enable viewers to derive first-hand knowledge on how autonomous vehicle works.

It will also allow the attendees to design their own mobility vehicle and experience a virtual test drive of the same.

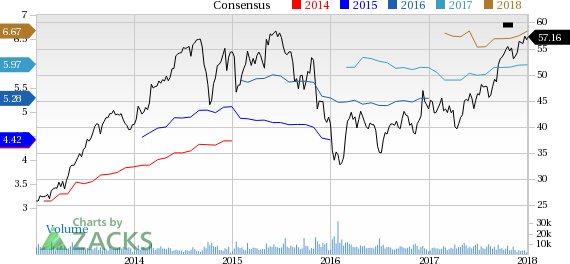

Magna International, Inc. Price and Consensus

Additionally, Magna will display its most recent electrification technology through e1 demonstration concept car. The e1 technology comprises one integrated e-drive system at both the front and rear axles with electric motors, which offer superior longitudinal and lateral dynamics.

Moreover, through CES 2018, the company aims to collaborate with new partners.

In fact, Magna has been growing its business through collaborations. Last October, the company had joined a consortium initiated by BMW and Intel (NASDAQ:INTC) to develop an autonomous and flexible vehicle platform for auto manufacturers by 2021. Prior to this in July, it had also signed an agreement with Michigan Department of Transportation and 3M to construct the first vehicle-to-infrastructure connected work zone in Michigan.

Price Performance

Shares of Magna have gained 5.6% in the last three months, outperforming the 0.2% decline of the industry it belongs to.

Zacks Rank & Key Picks

Magna carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are Toyota Motor Corporation (NYSE:TM) , BorgWarner Inc. (NYSE:BWA) and Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Toyota has an expected long-term growth rate of 6.2%. Over a month, shares of the company have gained 3.6%.

BorgWarner has an expected long-term growth rate of 8.6%. In the last six months, shares of the company have climbed 20%.

Volkswagen has an expected long-term growth rate of 12.9%. In the last three months, shares of the company have rallied 17.9%.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Magna International, Inc. (MGA): Free Stock Analysis Report

Original post

Zacks Investment Research