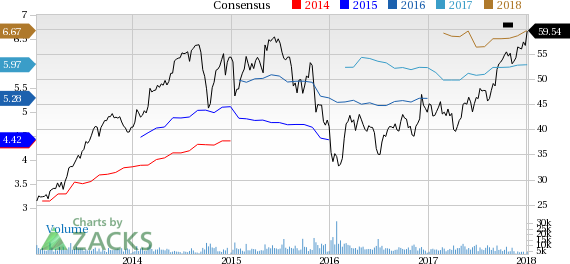

Shares of Magna International, Inc. (NYSE:MGA) scaled a 52-week high of $59.6 on Jan 5 before closing the day at $59.54 eventually.

Magna has a market cap of roughly $21 billion. Average volume of shares traded is around 938,608. The company has an expected long-term EPS growth rate of 9.5%.

The stock has not seen any estimate revision for fourth-quarter fiscal 2017 in the last 30 days. The Zacks Consensus Estimate for annual fiscal earnings also remains unchanged during the period.

Shares of Magna have gained 10% in the past three months, outperforming the industry’s 5.4% rise.

Driving Factors

At the start of January, Magna announced that it is set to launch its key products for the development of electrified and autonomous vehicles. Its advanced product line will include solutions for electrification, autonomy and mobility. Per the company, these technologies will help to form the future mobility of vehicles.

Additionally, the company aims to collaborate with new partners. In fact Magna has been of late growing its business through collaborations.

Last October, the company had joined a consortium initiated by BMW and Intel (NASDAQ:INTC) to develop an autonomous and flexible vehicle platform for auto manufacturers by 2021. Earlier in July, it had also signed an agreement with Michigan Department of Transportation and 3M to construct the first vehicle-to-infrastructure connected work zone in Michigan.

Magna International, Inc. Price and Consensus

Moreover, in the previous month, Magna announced the closure of its two share repurchase initiatives, announced on Nov 21, 2017.

In the first program announced on Dec 6, the company repurchased 1,472,000 common shares in total for an aggregate price of $101.2 million.

In the second program announced on Dec 29, it bought back 395,100 common shares for an approximate price of CAD $27.5 million. Shares acquired from both the programs have been cancelled.

These buyback programs are part of Magna’s normal course issuer bid for up to 35,800,000 common shares.

Further, the company has been paying regular dividends to its shareholders. The last hike was in February 2017 wherein it raised the quarterly dividend by 10% to 27.5 cents per share.

Magna quite routinely undertakes such capital deployment strategies, aiming to improve shareholder value and also increase share prices.

Zacks Rank & Key Picks

Magna carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) , Lear Corporation (NYSE:LEA) and LKQ Corporation (NASDAQ:LKQ) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Volkswagen has an expected long-term growth rate of 12.9%. In the last three months, shares of the company have rallied 24.7%.

Lear has an expected long-term growth rate of 7.1%. In the last three months, shares of the company have increased 10.1%.

LKQ Corp. has an expected long-term growth rate of 16%. In the last three months, shares of the company have jumped 14.7%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Volkswagen AG (VLKAY): Free Stock Analysis Report

Magna International, Inc. (MGA): Free Stock Analysis Report

Lear Corporation (LEA): Free Stock Analysis Report

LKQ Corporation (LKQ): Free Stock Analysis Report

Original post

Zacks Investment Research