Magna International Inc. (NYSE:MGA) has received a contract manufacturing from BMW, under which, it will be producing the latter’s new 530e plug-in hybrid model. The new hybrid vehicle will be produced at Graz, Austria from summer 2017.

As a manufacturing partner with two premium electrified vehicles – the BMW 530e and the previously Jaguar I-PACE - Magna International’s Graz facility currently displays its value proposition to the target customers.

The new contract from BMW demonstrates its reliability on Magna International’s contract manufacturing and electrified products. Production of BMW 5 Series marks the prolongation of the two companies’ 15-yearold partnership. Notably, the first BMW model produced by Magna International’s Graz facility is an X3 SUV in 2003.

Earlier in March, Magna International had started the split production on the BMW 5 Series sedan and will be soon commencing the production of Jaguar I-Pace, in the first quarter of 2018.

This year, the company celebrates three million vehicles production milestone for various automakers at its Graz facility.

Good news is that Magna International’s contract vehicle assembly facility in Graz is winning many new business contracts. Apart from BMW and Jaguar manufacturing deals, it has secured a contract extension on the Mercedes-Benz G-Class. With these, the plant is expected to reach production volumes of around 200,000 vehicles per year by 2018.

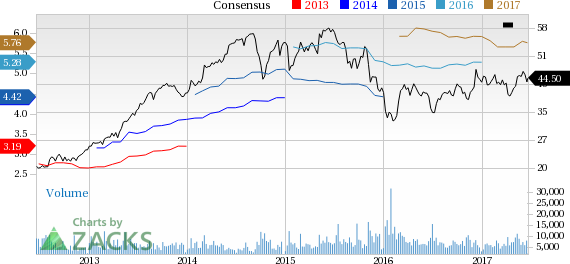

Price Performance

Magna International has outperformed the Zacks categorized Auto/Truck-Original Equipment industry in the last three months. The stock pegged at 4.9% rise compared with the industry’s gain of 3.9% during the period.

Zacks Rank & Key Picks

Magna International currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the auto space are Alison Transmission Holdings, Inc. (NYSE:ALSN) , Ferrari N.V. (NYSE:RACE) and Dana Incorporated (NYSE:DAN) . All three sport Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alison Transmission has an expected long-term growth rate of 11%

Ferrari has an expected long-term growth rate of 14.1%.

Dana has an expected long-term growth rate of 3%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Magna International, Inc. (MGA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Dana Incorporated (DAN): Free Stock Analysis Report

Ferrari N.V. (RACE): Free Stock Analysis Report

Original post

Zacks Investment Research