An Earnings Miss: Pipeline operator Magellan Midstream Partners L.P. (NYSE:MMP) reported adjusted earnings per unit of $1.04, lower than the Zacks Consensus Estimate of $1.12. Weak contribution from the Marine Storage operating segment led to the miss.

Estimate Revision Trend: Investors should note that the earnings estimates for Magellan Midstream moved up prior to the earnings release. The Zacks Consensus Estimate rose 1% over the last 7 days.

Revenue Outperformance: Magellan Midstream reported revenues of $673.3 million, above the Zacks Consensus Estimate of $663 million.

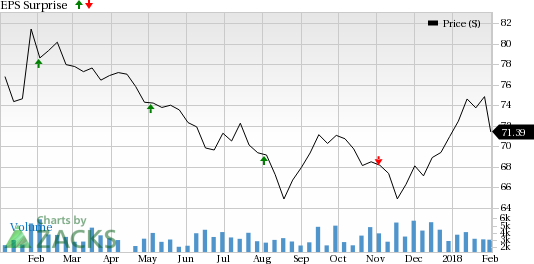

Zacks Rank & Surprise History: Currently, Magellan Midstream carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Coming to earnings surprise history, the company has a good record: its beaten estimates in three of the last four quarters resulting in an average positive surprise of 3.62%.

Key Stats: Operating margin from the Refined Products segment was $216.2 million compared with $191.4 million in the year-ago quarter.

Magellan Midstream’s Crude Oil unit generated $141.8 million of operating margin in the quarter compared to $111.8 million for the same period in 2016.

For the Marine Storage division, operating margin was $26.1 million, 25.7% lower than the $35.1 million earned in the year-ago period.

Magellan Midstream reported that its distributable cash flow (DCF) for fourth-quarter 2017 came in at a record $308.3 million, up 11.2% from the year-ago quarter.

2018 Guidance: Management expects to generate record distributable cash flows of approximately $1,050 million for the full year and is targeting annual distribution growth of 8%. Magellan guided towards first-quarter and full-year earnings per unit of 95 cents and $4.00, respectively.

The partnership plans to spend approximately $900 million on expansion projects in 2018, with expenditures of $375 million thereafter required to complete these projects. Additionally, the partnership continues to look out for more than $500 million of potential organic growth projects in the earlier stages of development.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Magellan Midstream Partners L.P. (MMP): Free Stock Analysis Report

Original post

Zacks Investment Research