An Earnings Miss: Pipeline operator Magellan Midstream Partners L.P. (NYSE:MMP) reported adjusted earnings per unit of $1.03, lower than the Zacks Consensus Estimate of $1.16. Weak contribution from the Crude Oil operating segment led to the miss.

Estimate Revision Trend: Investors should note that the Zacks Consensus Estimate for the quarter has been unchanged in the last seven days.

Revenue Outperformance: Magellan Midstream reported revenues of $865.7 million, above the Zacks Consensus Estimate of $710 million.

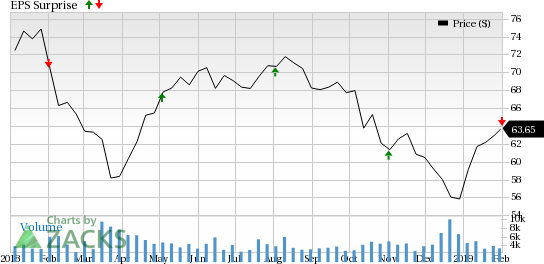

Zacks Rank & Surprise History: Currently, Magellan Midstream carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Coming to earnings surprise history, the company has a good record: its beaten estimates in three of the last four quarters.

Key Stats: Operating margin from the Refined Products segment was $349.3 million compared with $216.2 million in the year-ago quarter.

Magellan Midstream’s Crude Oil unit generated $129.8 million of operating margin in the quarter compared to $141.8 million for the same period in 2017.

For the Marine Storage division, operating margin was $30.7 million, 17.5% higher than the $26.1 million earned in the year-ago period.

Magellan Midstream reported that its distributable cash flow (DCF) for fourth-quarter 2018 came in at $302.4 million, down 1.9% from the year-ago quarter.

2019 Guidance: Management expects to generate distributable cash flows of approximately $1.14 billion for the full year and is targeting annual distribution growth of 5%. Magellan guided towards first-quarter and full-year earnings per unit of 90 cents and $3.80, respectively.

The partnership plans to spend approximately $1.3 billion on expansion projects in 2019, with expenditures of $400 million thereafter required to complete these projects. Additionally, the partnership continues to look out for more than $500 million of potential organic growth projects in the earlier stages of development.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Magellan Midstream Partners, L.P. (MMP): Get Free Report

Original post

Zacks Investment Research