E-commerce has been making life difficult for Macy’s (NYSE:M) even before the pandemic. The company was struggling to move the needle in terms of sales growth for years. The introduction of anti-Covid measures and lockdowns erased over $7 billion from its top line for a 28.5% decline in fiscal 2021. The stock plunged below $5 a share in March 2020, down 94% from its 2015 all-time high of $73.61.

But Macy’s survived the carnage and in fiscal 2022 sales were almost back to pre-pandemic levels. The share price, meanwhile, recovered to as high as $37.95 in November, 2021. And just when M was on the verge of gaining investors’ trust again, the stock fell over 55% to $16.95 last month. As of this writing, it trades close to $23.85. The question is whether this recent bounce is the start of a new uptrend or just a correction within the downtrend.

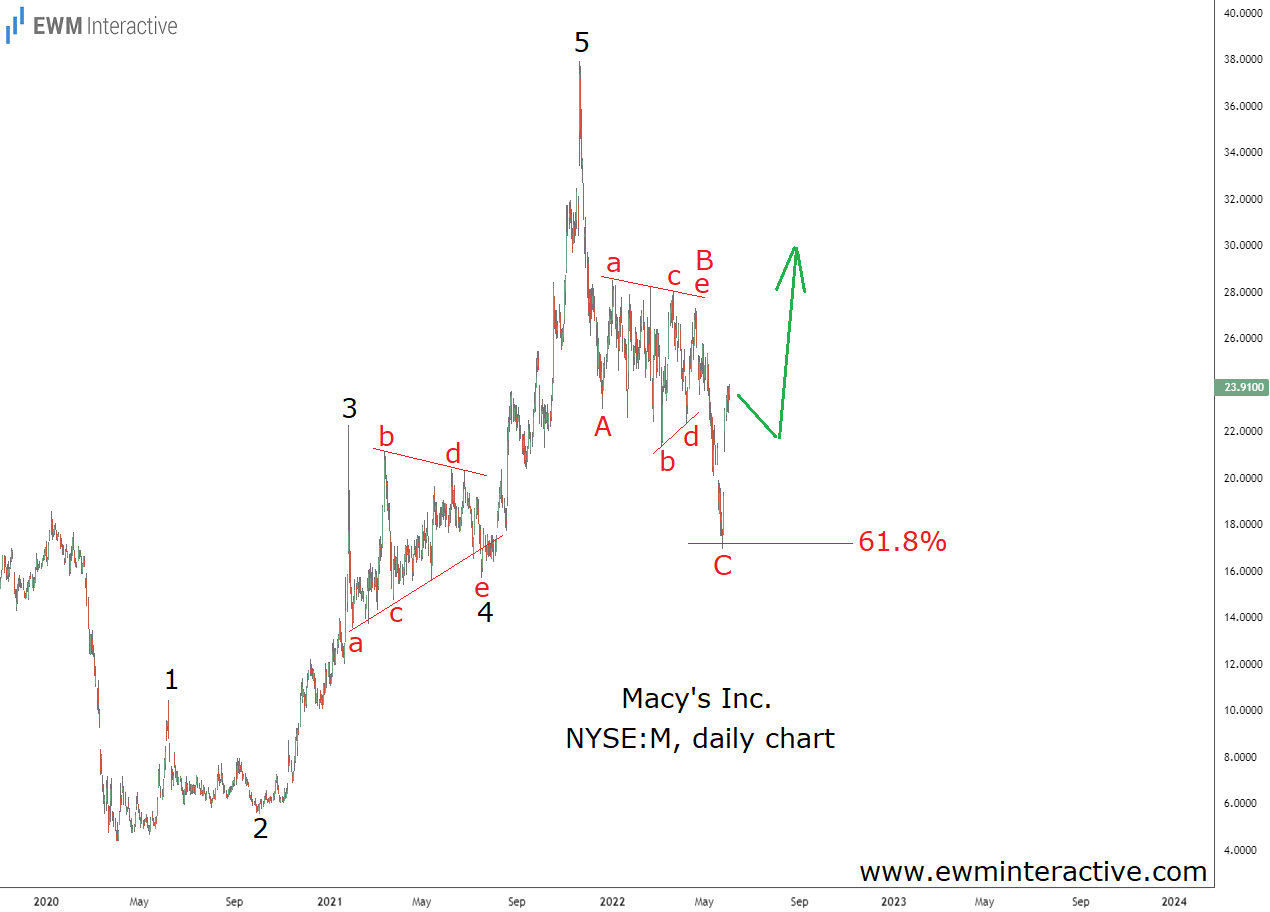

Fortunately for the bulls, the Elliott Wave chart above suggests it is the latter. The recovery from sub-$5 to nearly $38 a share is a clear five-wave impulse pattern labeled 1-2-3-4-5, where wave 4 is a triangle. According to the theory, and our personal experience, impulses only develop in the direction of the larger trend.

However, another rule states that a three-wave correction has to occur before the trend can resume. In the case of Macy’s, we have a complete A-B-C zigzag correction, whose wave B is, again, a triangle. If this count is correct, the stock has now drawn a complete 5-3 wave cycle and is poised to head north again. Furthermore, wave C seems to have ended just after touching the 61.8% Fibonacci support. The sharp bounce off this key level is a strong bullish sign, as well.

Initial targets for the anticipated rally lie above the top of wave 5 at $38. We won’t be surprised to see Macy’s climbing past $40 and even go for the $50 mark in the months ahead. In other words, the stock can double from here, especially considering that it trades at a forward P/E ratio of 5. Macy’s might be far from its heyday, but the market seems to have left it for dead. With a manageable debt load and $2B in annual free cash flow, this cannot be farther from the truth. And the charts agree.