Market movers today

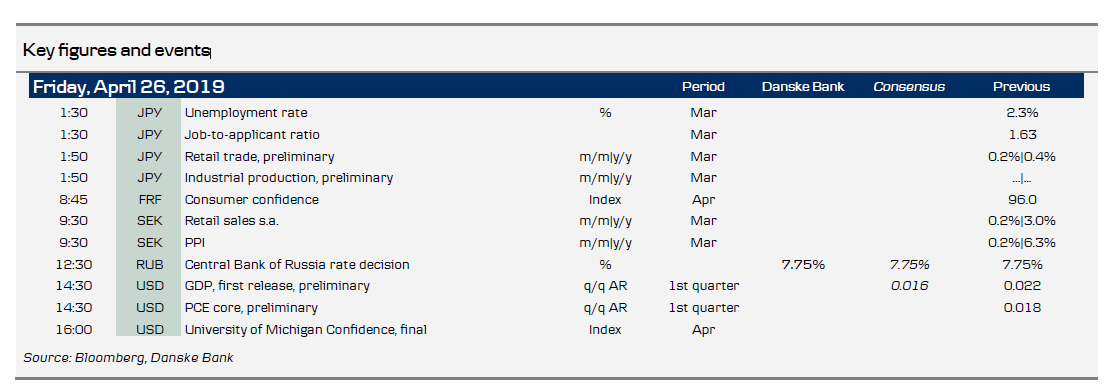

In the US , we get the first estimate of GDP growth in Q1 today. We expect to see a more or less unchanged GDP number for Q1 relative to Q4, 2018. However, a lower than expected number will add to the downward pressure on US Treasuries as political pressure for a rate cut will increase.

Today the Bank of Russia (CBR) will announce its monetary policy meeting decision on the key rate. In line with Bloomberg and Reuters consensus, we expect the CBR will keep the key rate unchanged at 7.75%. A softened ECB and Fed stance offers more room for the CBR to start cutting soon. We expect two 25bp cuts in 2019.

Italy and Greece up for review by S&P today. See more on page 2.

In Sweden , March PPIs and retail sale numbers are released today (see page 2).

Selected market news

French president Emmanuel Macron held a more than two hour long press conference yesterday, in which he promised cuts of EUR 5bn in personal income taxes, inflation indexing of monthly pensions below EUR 2,000 and no further closures of hospitals and schools for the remaining part of his term in a bid to stop the gilets jaune riots. While details of the plan did not become known until after close of the European session, expectations weighed on semi core and periphery throughout the day. French 10Y yields widened 2bp to Bunds and 10Y BTP widened 5bp.

US treasuries sold off early in the session yesterday after initially seeing surprisingly strong data on durable goods, but weaker earnings reports than recent days and an increase in initial jobless claims meant that treasuries ended the day up just 2bp. S&P500 was only little changed. Remaining in the US the effective Fed Funds rate (EFFR) fixed high for the fourth consecutive day at 2.44% - 6bp below the upper bound of the target range, but an entire 4bp above the IOER. While the EFFR has traded closer to the upper bound in the past, this has happened with the IOER only 5bp below the upper bound. The difference of 4bp has not been seen since back in 2008 when the facility was first introduced. While excess reserves remain large in a historical context, implementation of liquidity requirements is said to have pushed up structural demand for excess reserves. The high fixing has prompted speculations of an early end to the balance sheet run-off (currently set to end in September) and even a downward adjustment of the IOER.

According to a government official, British Prime Minister Theresa May has lost the race to avoid UK elections for the European Parliament on 23 May as the Brexit Bill probably won't come to the floor next week, and after which there is too little time to carry out a ratification of a potential agreement. According to the official the next target will be to have the bill passed by June 30 where the newly elected MEPs take seat in the Parliament.

Scandi markets

Sweden. Today Swedish March PPI and retail sales numbers are released. In a general perspective, retail sales have been fairly modest of late reflecting high savings in the household sector. Data for March/April are usually tricky to project due to Easter-effects. In any case, we are looking for 0.5% mom and 1.5% yoy.

Fixed income markets

The dovish tones out of the Riksbank yesterday saw 10Y yields fall almost 10bp and it is fair to say that the market was not prepared for the soft tone from the Riksbank. Given the lower rate policy path as well as continuing to front-load reinvestments, this will be supportive for Swedish government bonds as well as Swedish mortgage bonds going forward.

Today, Greece and Italy are up for review by S&P. Italy is on negative outlook and has been so for almost six months. Italy is rated BBB and is only two notches above junk-status. However, we do not expect Italy to be downgraded given the lower funding costs and the new TLTROs even though the deficit for 2019 has been revised upwards see more here. No change in the rating will be positive for BTPS. Greece is on positive outlook and we could see a one notch upgrade to BB- from B+ given the improvement in public finances and lower funding costs. Furthermore, the Periphery will be supported by index extensions as discussed here.

FX markets

Yesterday’s Riksbank decision ended up as a big disappointment for us (and the krona). The rate path was lowered by as much as 40bps at the end of the forecast horizon (Q1 2022), and the timing of the next hike was effectively shifted from Sep/Oct this year to year-end or even early 2020. On top of that, the board deemed it necessary to continue reinvestments of the Riksbank’s already vast bond portfolio. Admittedly, this was against our call for the meeting, and as such our 1M forecast of 10.35 seems very distant. The initial market reaction was to send the cross up above 10.65 (from 10.50), which seems reasonable given the shift in Riksbank tone. Lacking any near-term SEK triggers, we cannot rule out tests of the 2018 highs around 10.70 short term. If anything, the risks are tilted towards an even more dovish outcome from the next meeting (July), as we remain more pessimistic than the Riksbank on both domestic growth and inflationary pressure. We are in the process of reviewing our SEK forecast profile in light of the latest developments.

NOK also suffered from the dovish Riksbank message with EUR/NOK temporarily testing the high 9.60s. Historically, SEK-induced spikes in EUR/NOK have been profitable to sell. We think this is the case also this time as the impact on Norges Bank’s short-term policy setting is limited. We continue to see more upside for NOK/SEK which has hovered around the 1.10 threshold since the Riksbank announcement.

EUR/USD continued to trade firmly below 1.12 yesterday as for a fourth straight day the effective Fed funds rate was 2.44% only 6bp below Fed’s upper target bound, i.e. USD continues to find support from tight USD money-market conditions. We do not expect US Q1 GDP release today to be a significant market mover; rather the cross will likely be awaiting the Chinese PMI data released next week.