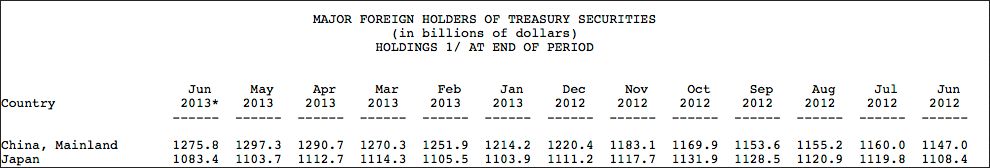

Once again we present the Treasury ‘TICs’ data for China and Japan, most recently available through June. It can be argued that these two countries are the T bond market, when considering the volume in which they deal and their strategic status as heretofore T bond consumers.

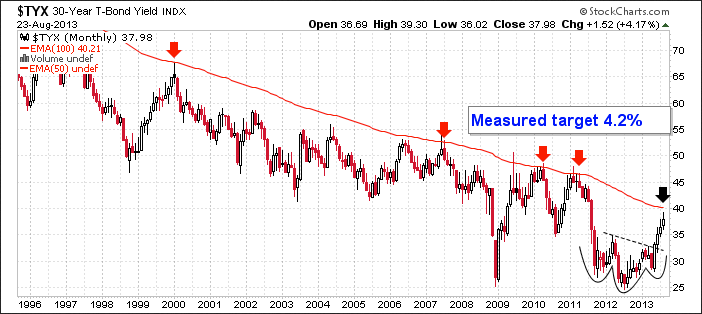

And now our long-running and most important macro chart, the ‘Continuum’ in long-term T-bond yields; a monthly view of the 30 year yield and its ‘limiter’ AKA the 100 month exponential moving average (red line).

We note that China and Japan had started net selling of T bonds in June just as a ‘would-be’ bottoming pattern became an actual bottoming pattern with a breakout through the neckline. The three-post-breakout months shown on the chart have featured a heavy rotation of Huey, Dooey and Louie in the media jawboning ‘QE Taper’ ever since.

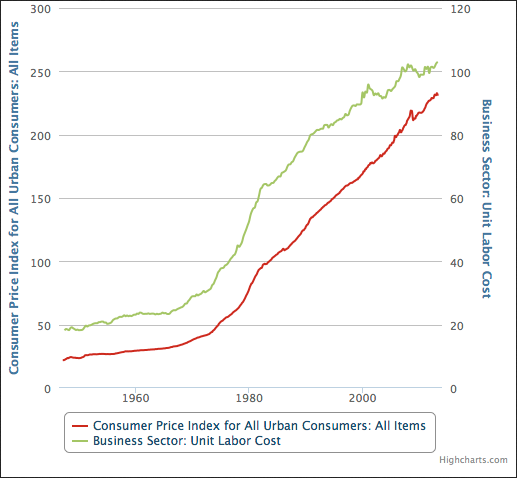

This all started after June, and as the TYX was bottoming, so can we please stop the cartoonish talk about decisions the Fed may or may not decide to make? The chart above told our heroes that it is time to talk ‘Taper’ and that is what they are doing, despite the backdrop of seemingly non-existent inflation; non-existent that is unless you count the already embedded inflation effects of the past.

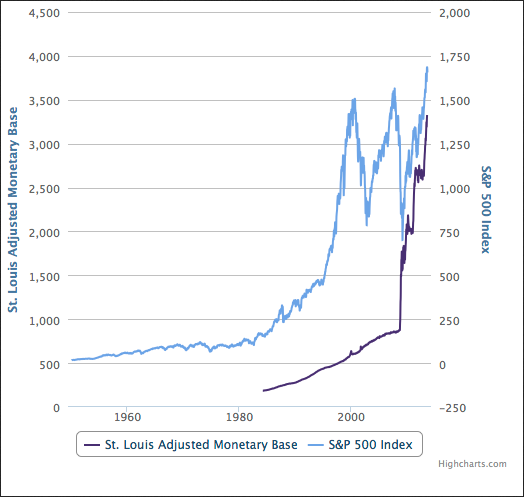

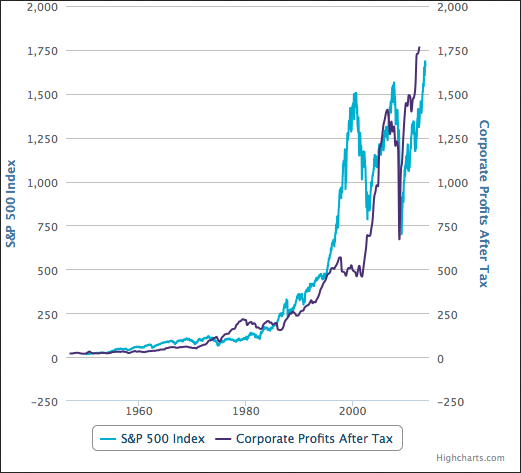

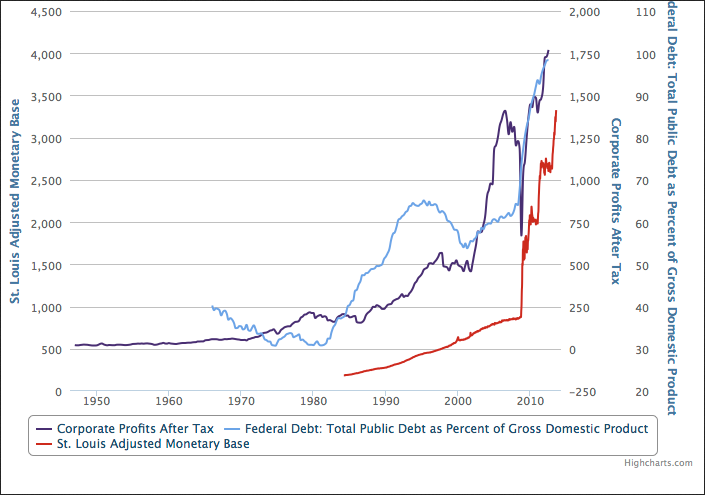

What we actually have is inflation working overtime, but fortuitously manifesting in the ‘right’ assets rising in response this time around. Once again, here is the S&P 500 doing what it was supposed to do and making heroes of policy makers as it rises in lockstep with the expanding Monetary BASE.

We again take this opportunity to note that the S&P 500 is not out of line valuation-wise, with the previous cyclical bull market. In fact, it has not yet reached the valuation per Corporate Profits that it did in the previous cycle. But then, these data points are only valid to people who consider inflation a valid tool to be used in effectively managing an economy.

Government debt (T bonds) has been used to manipulate and engineer the economy. Corporate profits have responded as T bonds were bought and monetized.

But when we review the TICs data and the nearly four-month trend in T-bond yields, we are left with the question of whether or not an ‘organic’ economy and a healthy stock market are in play or something utterly dependent on more debt and more inflation.

Bulls who are confident in the market’s origins and in line with heroic and very capable policy makers should be buying the current correction. I assume they are backing up the bravado with action and buying this “new secular bull market” opportunity.

Bears who are confident that the macro market’s books have been cooked should realize that these things do not just unwind the moment a few people begin to cotton on to the idea that manipulation never works in a sustainable or healthy way but rather, they should keep an eye on the 30-year yield and its EMA 100 ‘line in the sand’ as we have called it in the past at important macro turns.

That chart is a road map. We are going to a yield limit and it is due to bond market supply and demand dynamics. It can be argued that the Fed is in a box and needs a broad market liquidation in order to quiet down the signals.

The United States benefited from a labor arbitrage and a steadily rising bond market last decade right through 2012. This was in large part compliments of China’s desire to build out its economy and use the chronic debtors in the US (consumer nation) to do it. The EMA 100 has limited the yield at every point over the last few decades.

The degree to which global markets have been tampered with over the last two years calls into question whether or not the yield will finally breakout this time. If it breaks out, the US will likely see its ‘organic’ recovery go right down the tubes. If the yield is once again repelled, we will likely see a rush to T bonds amid a flight to ‘safety’ and an asset market liquidation. That could fuel a future leg to the current cyclical bull. Could, not ‘would’.

Big events have tended to happen at and around the EMA 100. The most recent example featured mobs with pitchforks calling for the head of “Helicopter Ben” and Bond King Bill Gross poking him in the eye with a big bet on inflation by shorting T bonds in 2011. That was a big turn from the secondary inflation hysteria after the big one blew out in 2008.

What will happen this time? Hey look, they have messed with the market’s ‘organic’ functioning so thoroughly that it is anybody’s guess. The precious metals appear to have spent two years recalibrating in preparation for a new phase. The US dollar is still bullish but in danger of losing a technical underpinning (reviewed in NFTRH this week), Europe’s market appears to have higher to go in the near term. Countless other markets and indicators appear to be heading toward pivot points, whether bullish or bearish.

It is beyond this post’s scope to get into a detailed analysis. We’ll just end by asking readers to doubly question any and all assumptions or overly confident predictions going forward. Especially the ones that stimulate a greed response. Changes are coming and if they coincide with the 30-year yield’s status as they have in the past, they are coming soon.

Do the work.

(charts courtesy of SlopeCharts)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Macro Markets Shrug Off Policy Makers, Ready For Pivot

Published 08/26/2013, 10:49 AM

Updated 07/09/2023, 06:31 AM

Macro Markets Shrug Off Policy Makers, Ready For Pivot

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.