In spite of improved hedge fund performance during Q3-2012, hedge funds with Macro strategy focus continued to struggle (as discussed earlier).

HedgeWeek: Macro hedge funds detracted from industry wide gains on weakness in trend following and commodity exposures, with the HFRI Macro Index posting a decline of 0.26 per cent; the September decline was the second consecutive monthly decline for macro. Systematic macro funds posted declines on short exposures to equities and commodity metals, as the HFRI Macro: Systematic/CTA Index posted a decline of 0.9 per cent. Discretionary macro and currency focused strategies had positive contributions from positions concentrated in USD/EUR, global equities and short fixed income.

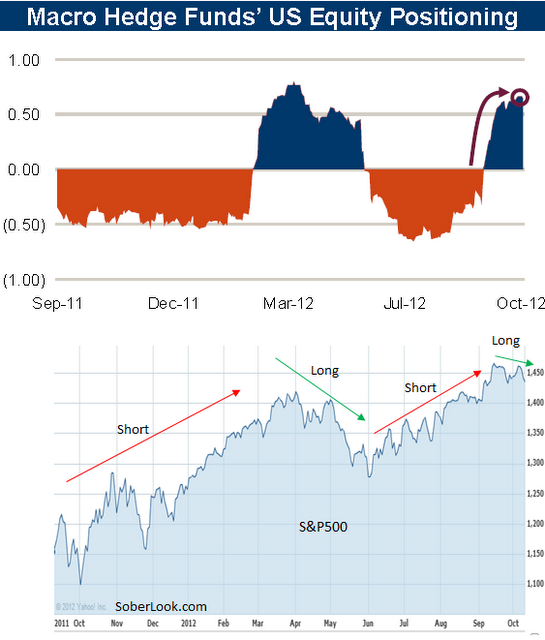

Their poor performance can be explained in one sentence: Macro hedge funds are terrible at timing financial markets. The chart below shows Macro hedge funds' positioning in equities over time. "1" means maximum long allocation to equities (on a net basis) and "-1" means maximum short allocation.

These investment "professionals" missed the rally from late last year into early this year (in spite of signs pointing to markets being oversold at the time). They also missed the correction this spring and early summer (in spite of signs pointing to froth in the markets) and then again missed the ECB-induced rally.

To be sure, predicting what central banks and politicians will do and how markets will be impacted is not an easy task. Many investors got whipsawed by some of these same events. But why is it that Macro hedge funds get paid 2/20 (or similar fees) and shouldn't they be better at this than the average investor?

And now they are positioned with a long bias. Given Macro funds' average track record recently, that bet does not bode well for the equity markets going forward.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Macro Hedge Funds Stink At Market Timing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.