The U.S. aerospace and defense industry has been on a growth trajectory since the beginning of the year, courtesy of a number of favorable factors both domestic as well as international. Also, Trump’s latest moves and policies have been helping the stocks to recover from the losses incurred due to the budget sequestration imposed by the previous administration.

Coming to the third quarter’s performance, the industry ended the period on a positive note racking up a market-thumping return. Evidently, the Zacks Aerospace-Defense industry gained 16.8% in the September quarter, higher than the S&P 500’s return of 3.8%.

To understand what led the defense stocks to outperform the broader market, we have briefly mentioned below the factors that boosted the industry in the past three months.

Budget Upside

Of late, geo-political tensions and terrorist activities are on the rise globally. These incidents have been driving the demand of defense products, in turn providing a substantial impetus to the stocks. Also, the recent U.S. budgetary amendments have been driving the stocks.

To this end, the recently approved defense bill policy worth $700 billion is worth mentioning. In particular, on Jul 14, 2017, the U.S. House passed the FY18 defense policy bill worth $696.5 billion that surpassed Trump’s March budget request worth $610 billion.

Finally, in late September, the Senate approved a $700 billion National Defense Authorization Act, which included a funding provision of $640 billion for national defense spending and $60 billion for Overseas Contingency Operations. It goes without saying that the funding significantly boosted the growth prospects of defense stocks.

Trump’s Take on International Issues

The global market, during the third quarter, witnessed continued cross-border tension between North Korea and the United States as the former conducted repeated missile tests targeting the United States and its allies.ratio

These rapid altercations boded well for the U.S. defense bellwethers as rising geopolitical tensions always prompt the government to strengthen its arsenals. The hostile activities of North Korea and the U.S. administrations‘ repeated warnings to the nation, in response, provided a strong impetus to a number of defense majors, which scale new all-time highs in Q3.

Moreover, in late August, while discussing his Afghanistan strategy, Trump announced plans to not to withdraw forces from the nation but “fight to win,” integrating diplomacy with military power. Following this announcement, defense stocks moved north in anticipation of escalated military actions. We believe Trump’s foreign policy will also provide further impetus to these stocks.

Prudent Deals

Recent merger deals between major aerospace and defense companies have also been acting as major catalysts for the industry.

In September, United Technologies Corp. (NYSE:UTX) agreed to buy Rockwell Collins Inc (NYSE:COL). for $30 billion. Once completed, the deal will create one of the world’s largest aircraft-equipment manufacturers.

With the acquisition, Rockwell Collins’ commercial and military aircraft avionics business will merge with United Technologies’ wide portfolio that includes aircraft engines, structures, cockpit and cabin controls, ventilation systems and other electronic and mechanical devices used in aviation.

On the other hand, later in the same month, Northrop Grumman inked a deal to buy Orbital ATK (NYSE:OA) for $9.2 billion. With the acquisition, Northrop Grumman will benefit from Orbital ATK's rocket motors, missiles and electro-optical countermeasure product lines.

5 Stocks Worth Adding to Your Portfolio

With the industry outperforming the broader market in the September quarter and promising to yield higher returns, we have shortlisted five defense stocks that have rallied more than 10% during the third quarter and have outperformed the S&P 500’s gain.

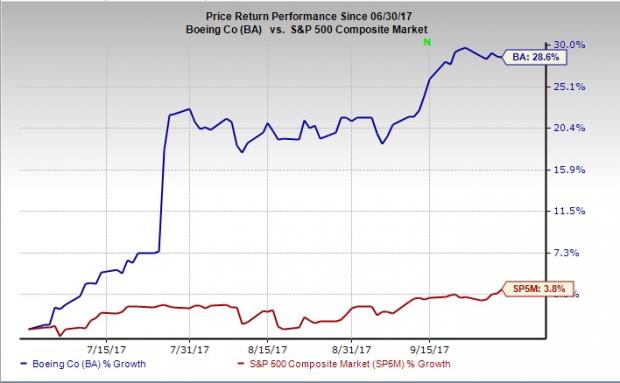

The Boeing Co. (NYSE:BA) is the largest aircraft manufacturer in the world in terms of revenues, orders and deliveries. It is also one of the largest aerospace and defense contractors. Apart from manufacturing combat-proven military jets and high-end commercial aircraft, Boeing also produces missiles and related weapons and works in tandem with NASA in the Space Launch System.

Boeing currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for the company has increased 7.7% for the third quarter. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s stock has surged 28.6% in Q3, outperforming the S&P 500’s rise of 3.8%.

Huntington Ingalls Industries, Inc. (NYSE:HII) designs, builds and maintains nuclear-powered ships such as aircraft carriers and submarines, and non-nuclear ships, such as surface combatants, expeditionary warfare/amphibious assault and coastal defense surface ships for the U.S. Navy and Coast Guard. The company provides after-market services for military ships around the globe.

The company currently flaunts a Zacks Rank #2. Its earnings are expected to improve 22.2% in the yet-to-be reported third quarter.

Huntington Ingalls’ stock has surged 21.6% in Q3, outperforming the S&P 500’s rise of 3.8%.

Northrop Grumman Corporation (NYSE:NOC) supplies a broad array of products and services to the U.S. Department of Defense, including electronic systems, information technology, aircraft, space technology and systems integration services.

The company currently holds a Zacks Rank #2. Its sales are expected to improve 2.6% in the yet-to-be reported third quarter.

Northrop’s stock has surged 12.1% in Q3, outperforming the S&P 500’s rise of 3.8%.

Leidos Holdings, Inc. (NYSE:LDOS) is a global science and technology company that provides technology and engineering services and solutions in the defense, intelligence, civil and health markets.

The company currently carries a Zacks Rank #2. Its sales are expected to improve 34.1% in the yet-to-be reported third quarter.

Leidos’ stock has surged 14.5% in Q3, outperforming the S&P 500’s rise of 3.8%.

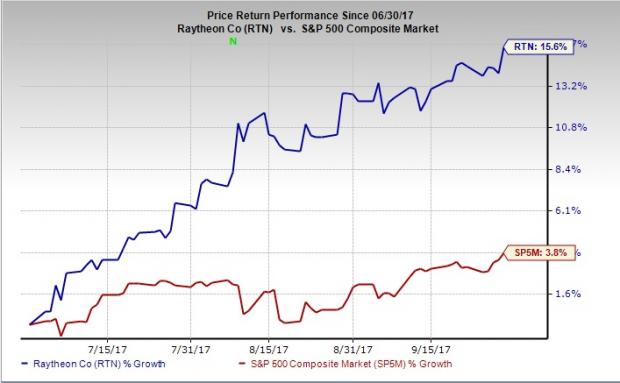

Raytheon Company (NYSE:RTN) is one of the largest aerospace and defense companies in the United States with a diversified line of military products, including missiles, radars, sensors, surveillance and reconnaissance equipment, communication and information systems, naval systems, air traffic control systems and technical services.

The company currently carries a Zacks Rank #2. Its earnings are expected to improve 5.9% in the yet-to-be reported third quarter.

Raytheon’s stock has surged 15.6% in Q3, outperforming the S&P 500’s rise of 3.8%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

Orbital ATK, Inc. (OA): Free Stock Analysis Report

United Technologies Corporation (UTX): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research