It has been more than a month since the last earnings report for Mack-Cali Realty Corporation (NYSE:CLI) . Shares have lost about 12.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Mack-Cali Misses Q2 FFO Estimates, Lowers Guidance

Mack-Cali reported second-quarter 2017 core FFO per share of $0.60, missing the Zacks Consensus Estimate by a penny. However, the figure came in 9.1% higher than the prior-year quarter tally.

The year-over-year increase in core FFO per share was driven by higher base rents in 2017 and interest expense savings from refinancing of high-rate debt.

Total revenue of $162.8 million exceeded the Zacks Consensus Estimate of $150.9 million and increased 9.1% from the prior-year quarter.

Quarter in Detail

During the quarter, Mack-Cali executed 48 lease deals, spanning around 728,246 square feet, at its consolidated in-service commercial portfolio. This comprised 18% for new leases, and 82% for lease renewals and other tenant-retention deals.

As of Jun 30, 2017, Mack-Cali’s consolidated Core, Waterfront and Flex properties were 89.9% leased, down 50 basis points (bps) from the prior-quarter end.

Further, rental rate roll up for the second-quarter transactions in the company’s Core, Waterfront and Flex properties was 6.6% on a cash basis and 17.7% on a GAAP basis.

Liquidity

Mack-Cali exited second-quarter 2017 with cash and cash equivalents of $21.7 million, down from $31.6 million recorded at the end of the prior year.

Further, as of Jun 30, 2017, the company had a debt-to-undepreciated assets ratio of 47.5% compared with 43.8% as of Mar 31, 2017.

Guidance

Mack-Cali revised its guidance for full-year 2017. The company now expects FFO per share in the band of $2.18–$2.28, indicating a decline of $0.09 from the prior disclosed guidance mid-point.

This reflects $0.06 per share impact from lower leasing starts and $0.03 per share impact due to increased debt reduction in lieu of office acquisitions projected for the second half of 2017.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

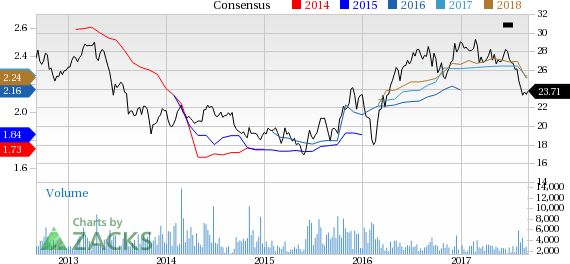

Mack-Cali Realty Corporation Price and Consensus

VGM Scores

At this time, Mack-Cali's stock has a subpar Growth Score of D, a grade with the same score on the momentum front. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value investors based on our style scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Mack-Cali Realty Corporation (CLI): Free Stock Analysis Report

Original post

Zacks Investment Research