In the early aughts, the pop music blasting from the MAC cosmetics counter could be heard above everything else on the ground floor of your local department store. This was pre-great-recession.

We shopped in-store for the perfect bubblegum pink lip because we wanted to stand out and we didn’t care how much it cost. We looked like clowns, but we felt like pop stars.

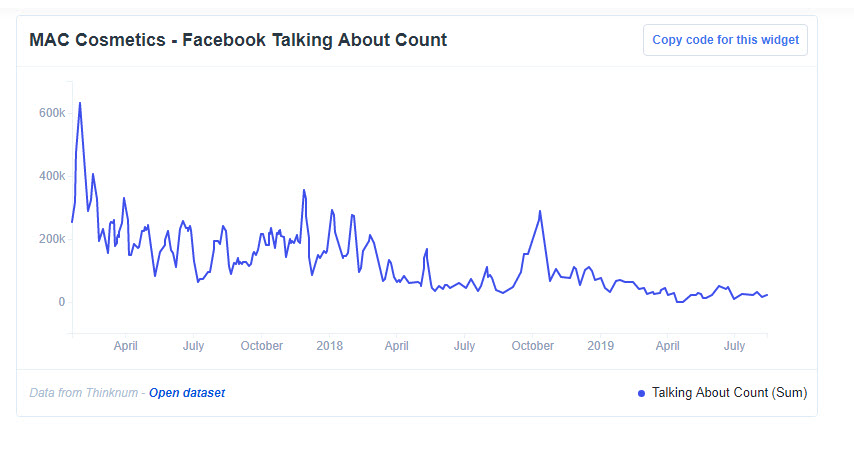

More than a decade and a half later, and the demand early millennials had for the dramatic looks MAC is known for has somewhat been replaced by the Gen Z-ers love of the dewy, iridescent vibe that younger brands like Milk Makeup and Glossier – heavily advertised on Facebook Inc (NASDAQ:FB) and Instagram – provide.

Estee Lauder (NYSE:EL) – the parent company for MAC, Clinique, Bobbi Brown, Smashbox and other premium cosmetics brands released its quarterly earnings on August 19th.

Estee Lauder is a leader in the cosmetics group of consumer goods. Recent acquisitions of millennial favorites BECCA and Too Faced, keep EL’s portfolio fresh. As for MAC tastemakers may not be using the brand for their Facebook live makeup tutorials or touting its bold colors as much as they were last year.

Other data is looking healthier - with moderate job posting gains over the quarter.

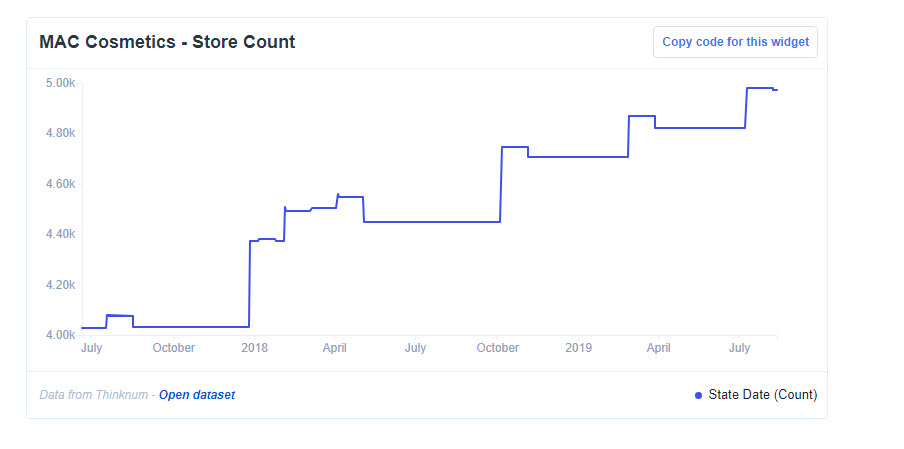

MAC’s expanding store count shows confidence that there’s room for revenue growth. Consumers still want to walk into stores feeling like Britney’s shy “Not a Girl, Not Yet a Woman” and strut out feeling like Beyonce’s fierce “(Girls) Run the World.”

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI