I get a sense that the investment world has begun to discount the possibility of a significant increase in inflation over the next few years. I think it’s a pretty big mistake. The housing market appears to have bottomed out and with that, loan demand should start increasing. With a down housing market no longer dragging loan demand to the floor, what’s left to hold back inflation?

The U.S. Federal government continues to create a massive amount of new money each year with large budget deficits. These act as a fiscal stimulus that has been roughly around 8%-10% of GDP over the past few years. That’s a lot of new money!

Loose Policy

Federal Reserve policies are loose. That wasn’t really much of a problem with a weak housing market dragging down loan demand, but now that housing is rebounding, I’d worry a bit more about this. The Feds totally ignored the last bubble, which started around 1998 and was exacerbated greatly by Fed policies in 2001 and 2002. What actually worries me more isn’t the “loose Fed policies” so much as the dedication to keep those policies loose until certain (perhaps unreasonable) conditions are met, such as 6.5% unemployment.

So based on all of this, I’ve become more concerned about rising inflation. I’ve been watching a few key indicators over the past several months. M2 money supply is among them. I feel like our high M2 money supply growth rate is being virtually ignored by the investment community right now, which is a mistake.

Here are the latest figures. The chart below shows the year-over-year M2 growth rate.

Might not look too meaningful at first glance, but notice we’re back at the levels seen during the bubble years and the early to mid 80′s. What’s particularly notable about this is that the late 90′s bubble years were marked by higher nominal GDP growth, whereas the current environment is not; which would suggest that having a 6%-10% M2 growth rate is a much bigger problem now than in 1998, for instance.

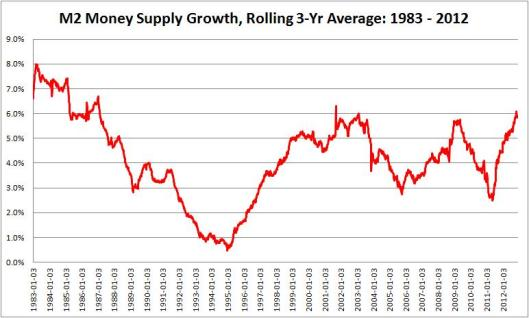

If that charts seems too spikey to get a handle on, here’s a rolling three-year average of M2 money supply, which might be more meaningful.

This chart looks even uglier than the first. Once we start to level out some of the spikes, we begin to see that the sustained long-term M2 money supply growth rate right now is actually at one of the highest points in the past 25 years. We have a three-year average of 5.9%, which is on par with the 6.3% peak in 2001. Except, once again, only without the economic growth of that era.

These figures, as well as the US’s massive budget deficits and the Fed’s new-found dedication to permanently loose monetary policy are frightening. I wouldn’t overreact -- many commentators over the past few years have warned of hyperinflation, but that’s extremely unlikely.

In actuality, with the way our system works, what’s more likely is that inflation spikes, which then forces the Feds to suddenly raise interest rates, creating a new recession. But regardless, none of this is beneficial and I would not be shocked to see a return to the up-and-down stagflationary markets of the 1970′s.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

M2 Money Supply And The Danger Of Rising Inflation

Published 12/20/2012, 01:30 PM

Updated 07/09/2023, 06:31 AM

M2 Money Supply And The Danger Of Rising Inflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.