A new report published in May says global sales of luxury goods have a shot at fully recovering to 2019 levels this year. Consultancy firm Bain & Company believes there’s a 30% probability that the luxury market could meet or exceed $340 billion in sales of high-end items like apparel, handbags and jewelry, which would be the most in two years.

This marks an adjustment up from Bain’s prior forecast of a full recovery by 2022 or 2023. What’s changed, the Boston-based group says, is China and the United States’ unexpectedly strong economic rebounds thanks, in large part, to swift vaccine distribution.

Some may question Bain’s optimism. After all, the luxury goods market saw its biggest annual decline on record in 2020, falling 23% due to pandemic-related lockdowns and financial uncertainty.

But a recovery has already begun. The French luxury giant LVMH Moet Hennessy Louis Vuitton (OTC:LVMUY) announced in April that it had returned to growth in the first quarter, with $16.75 billion in sales across its more than 70 brands. Fashion and leather goods in particular had an excellent start to the year, generating record revenue of $6.7 billion, or 37% higher than the same period in 2019.

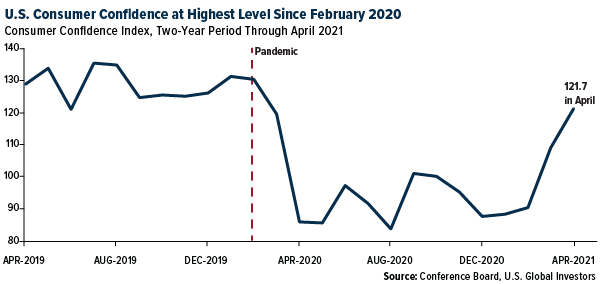

Like Bain, I’m very bullish and believe that U.S. and Chinese consumers are well-positioned to maintain this momentum. Vaccines continue to be administered, though at a slightly slower pace than before, while stimulus checks helped U.S. disposable incomes jump an unheard-of 29% in March compared with the same month last year. More than $17 trillion sit in U.S. commercial banks at a time when consumer confidence has climbed to its highest level since soon before the pandemic.

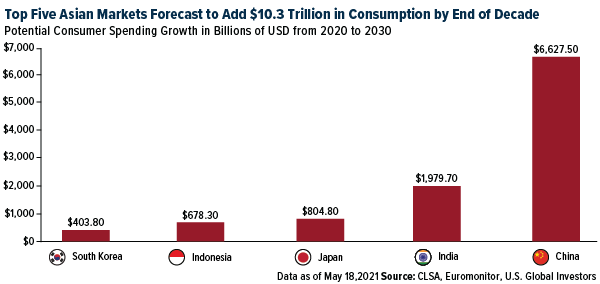

Asia Projected To Contribute $10.3 Trillion in New Spending By 2030

Consumers in China have likewise shown incredible resilience. According to the National Bureau of Statistics, retail sales of consumer goods rose 17.7% in April compared with the same month in 2020, 8.8% compared with April 2019. As strong as this growth sounds, it’s a slight slowdown from February and March, when sales increased 33.8% and 34.2%, respectively, over last year.

Looking ahead, China is set to contribute an additional $6.6 trillion in global consumption between now and the end of the decade, according to Hong Kong investment bank CLSA. When combined with four other large Asian markets—India, Japan, Indonesia and South Korea—the total amount in new consumer spending could be as much as $10.3 trillion.

If accurate, this could be highly supportive of the luxury goods market, which already depends on a strong Asian consumer base. As CLSA analysts write, Asian members of Generation Z—those born between 1995 and 2009—represent the largest consumer base in the region through 2030 at nearly 1 billion strong. They’re more affluent and better educated than older demographic groups, and their spending habits more closely resemble those of Western consumers as incomes steadily rise.

A Way To Play The Luxury Boom

I believe an attractive way to play the recovery in luxury sales is with our Global Luxury Goods Fund (USLUX). As its ticker suggests, USLUX is truly global, with half of the fund containing companies domiciled in the U.S. The other half includes companies in Western European markets—primarily Germany, France and Switzerland—and Canada.

USLUX is well-diversified, with exposure to not just traditional luxury goods manufacturers (think LVMH, Burberry (OTC:BURBY) and Prada (OTC:PRDSY)) but also car-makers (Tesla (NASDAQ:TSLA), BMW (OTC:BMWYY), Ferrari V (NYSE:RACE)), retailers (Costco (NASDAQ:COST), Home Depot (NYSE:HD)) and even gold producers (Barrick (NYSE:GOLD), Newmont (NYSE:NEM)).

Why gold producers, who might ask? Jewelry manufacturers represent the second largest source of demand for physical gold following investment, putting gold miners near the front of the luxury goods supply chain.

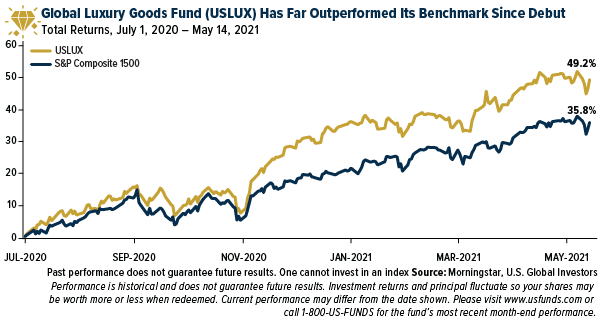

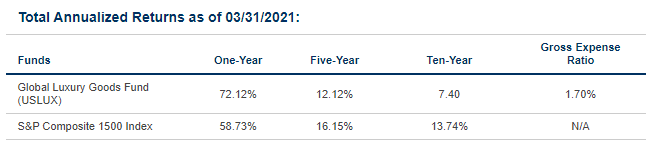

USLUX changed its investment strategy on July 1, 2020, and since then, the fund has far outperformed its benchmark, the S&P Composite 1500. USLUX was up close to 50% as of May 14 where the index was up 35%.

Interested in learning how to invest with style? You can find everything you’re looking for, from the USLUX fact sheet to historical performance, by clicking here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Expense ratios as stated in the most recent prospectus. Total annual expenses after reimbursement were 1.58%. Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

The fund changed its investment strategy on July 1, 2020. Prior to that date, the fund invested in a diversified portfolio of equity of equity-related securities of companies in the S&P Composite 1500 Index, with a focus on companies achieving high return on invested capital metrics and an emphasis on mid-capitalization companies. Different investment strategies may lead to different performance results. The fund’s performance for periods prior to July 1, 2020 reflects the invest strategy in effect prior to the date.

Mutual fund investing involved risk. Principal loss is possible. Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Companies in the consumer discretionary sector are subject to risks associated with fluctuations in the performance of domestic and international economies, interest rate changes, increased competition and consumer confidence.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Consumer Confidence Index (CCI) is a survey, administered by The Conference Board, that measures how optimistic or pessimistic consumers are regarding their expected financial situation. The S&P Composite 1500 combines three leading indices, the S&P 500, S&P MidCap 400 and S&P SmallCap 600, to cover approximately 90% of U.S. market capitalization.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Global Luxury Goods Fund as a percentage of net assets as of 3/31/2021: LVMH Moet Hennessy Louis Vuitton SA (PA:LVMH) 5.80%, Tesla Inc. 4.54%, Costco Wholesale Corp (NASDAQ:COST). 4.29%, The Home Depot Inc (NYSE:HD). 2.67%, Prada SpA 0.88%, Burberry Group (OTC:BURBY) PLC 0.85%, Ferrari NV (NYSE:RACE) 0.71%, Barrick Gold (NYSE:GOLD) Corp. 0.38%, Newmont Corp. 0.35%.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Luxury Goods Sales Projected To Recover To 2019 Levels This Year

Published 05/27/2021, 01:34 PM

Updated 07/09/2023, 06:31 AM

Luxury Goods Sales Projected To Recover To 2019 Levels This Year

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.