Happy Lunar New Year; the year of the fire monkey has begun.

LNY has an interest effect on Asian markets as there is an eerie quiet, with only Japan and Australia open for business for most of the week. Singapore, Hong Kong and mainland China are all closed for LNY. Volumes will be well below average and there tends to be a build-up of global leads that is released once Asian investors return to their desk – expect ‘release valve’ trading late in the week.

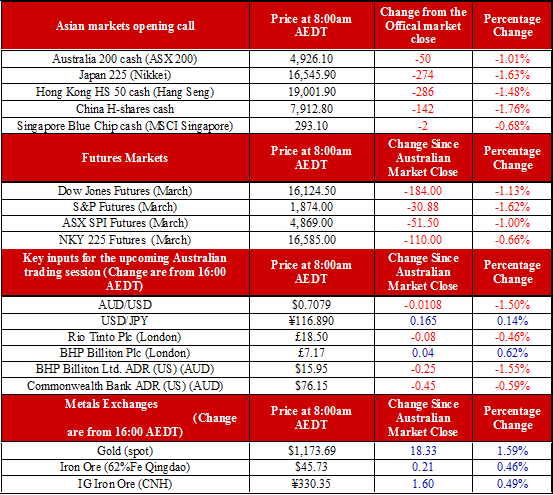

Weekend inputs

Two interesting macro inputs drove futures and currencies over weekend – the biggest was clearly the reaction to the non-farm payrolls (NPF). The second was the PBoC Q4 announcements.

If ever there was an advisement for stop losses Friday’s NFP was it:

Headline job creation numbers were poor with only 151,000 jobs added in December versus consensus of 190,000; USD was shed immediately.

A second glance showed unemployment fell to 4.9% - the lowest level since 2008. Wage growth was much stronger than expected and conditions strengthened. This lead to a very sharp reversal in USD trade, triggering all sorts of mayhem in currency-land.

The NFP also pushed expectations on the Fed funds futures back into hike territory, although it is only signalling 1.5 hikes at best.

The NFP also caught up on the Street rumours that several major investment banks are running the numbers on scenarios that might lead to a global and localised recessions, considering 2016 has seen several factors at high five-to-seven-year lows. These two factors combined might explain the extended selling in equity futures on Saturday morning.

A summary of the PBoC’s Q4 monetary statement:

Suggests reserve requirement ratios could be cut further to push the RMB lower.

Warned against ‘large-scale’ monetary easing (similar to that on August 2015).

Tone was edging on the ‘dovish’ side.

Average benchmark interest rates was 5.64% in December, a fall of 37 basis points on the September quarter. Its has lost 128 basis points year-on-year.

Foreign reverses fell US$99.5 billion in January – less than estimated. However, this sees the reserve levels at US$3.23 trillion – the lowest level since 2012. It was also the first time ever China has seen its cash stockpile decline on an annual basis.

Outflows remain high; however, the positive signal from the report shows a substantial amount of the capital outflows are private enterprises paying down debt.

The next date to watch for China is 23 February when the PBoC is due to meet to discuss how it will handle its capital flows for 2016. With the RMB is now part of the IMF’s reverse basket, the rules stipulate that roughly a third of its currency needs to be on hand to meet its requirements. Normally these reverses are held in sovereign bonds but a substantial amount is currently in infrastructure, which is not exactly liquid. Shifting out of these infrastructure products will create liquidity shortfalls – an interesting dilemma and interesting macro risks for the next few week. The question is: Will there be a build-up in markets ahead of China’s return?

Australia and Japan are therefore the only equity markets of note open. Australia sees half-year earnings season beginning in earnest today, with JB Hi-fi and Ansell first off the rank. We’re not expecting any fireworks considering both have pre-announced. I do, however, remain fixed on CBA’s Wednesday announcement as it could be a trigger point in the financial services sector and may see a bounce considering the market has sold down financial firms.