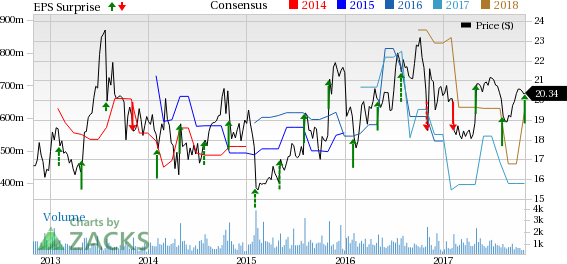

Headquartered in Austin, TX, Luminex Corporation (NASDAQ:LMNX) reported earnings of 19 cents per share in the third quarter of 2017, surpassing the Zacks Consensus Estimate of 2 cents by a massive 850%. Earnings also increased 216.7% year over year.

Revenues in the quarter increased almost 4.1% year over year to $74.1 million, almost in line with the Zacks Consensus Estimate of $74 million.

Segment Analysis

System Sales: Revenues declined 5.6% on a year-over-year basis to $9.9 million. Notably, the company shipped 266 multiplexing analyzers in the reported quarter. Here we note that the systems included MAGPIX, LX and FLEXMAP 3D.

Assay Revenues: Assay revenues grew 16.9% year over year.

Royalty Revenues: Coming to royalty revenues, sales at this segment declined 0.6% on a year-over-year basis to around $11 million. Royalty revenues in the reported quarter were affected by a reduction in audit findings and minimum royalty payments, offset by an increase in base royalties.

Consumables Sales: Revenues at the segment declined 13.7% to $10.6 million. This was owing to the effects of the timing of orders from the company’s large partners.

Quarter Highlights

Positive Tidings on the Regulatory Front: Luminex received FDA clearance for the ARIES C. difficile Assay in the reported quarter. Also, Luminex announced the receipt of CE-IVD mark for the ARIES Norovirus Assay.

Luminex also announced that Japan's Central Social Insurance Medical Council has approved the recommendation by the Japanese Ministry of Health, Labor and Welfare (MHLW) to provide reimbursement for its proprietary VERIGENE assays. The approval was for two VERIGENE assays — the Gram-Positive Blood Culture test and the Gram-Negative Blood Culture test. Notably, Luminex is the only company in Japan with a clear automated sample-to-answer solution for blood culture identification.

Molecular Diagnostic Business Solid: Molecular Diagnostics Group placed more than 60 Sample-to-Answer systems in the reported quarter. The company now has more than 600 molecular Sample-to-Answer systems under contract with a total number of 400 active customers. Moreover, on average, VERIGENE customer now generates nearly $95,000 in assay revenues a year, while ARIES generates more than $40,000 a year as a reference.

Margins Details: Gross margin was 61.8% in the reported quarter, highlighting a contraction of 231 basis points (bps) year over year. The company has also made some standard cost adjustments related to improvements in labor utilization in the reported quarter to improve product margins, but the necessary adjustments to inventory in the current quarter affected the gross margin.

Operating expenses decreased 5.2% on a year-over-year basis. R&D expenses in the quarter were down 16.4% on a year-over-year basis. Meanwhile, SG&A costs inched up 0.2% year over year to $26.5 million. As a result, operating margin, as a percentage of revenues, was 11.7% and expanded 259 bps in the third quarter.

Financial Condition: The company exited the third quarter with approximately $110.9 million in cash and investments, up from $103.7 million in the second quarter.

Guidance

Luminex reiterated its 2017 annual revenue guidance at the band of $300 million to $310 million. This depicts 11% to 14% growth on a year-over-year basis. Luminex expects gross margins for the next few quarters in the mid-60s.

Meanwhile, the company projects fourth-quarter 2017 revenues in the range of $76 million to $78 million.

Our Take

Luminex exited the third quarter on a solid note. The company’s third quarter saw a strong top line, solid cash flow as well as profits. The company’s Assay business will be its key growth driver over the long term. The company also witnessed favorable tidings at the regulatory front.

Further, the expansion in operating margin buoys optimism. On the flipside, low consumable revenues raise concern. Furthermore, the year-over-year drop in R&D expenses is discouraging. Cutthroat competition in the niche space is another headwind.

Zacks Rank & Other Key Picks

Luminex sports a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Thermo Fisher Scientific Inc. (NYSE:TMO) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed sports a Zacks Rank #1, while Thermo Fisher Scientific and Intuitive Surgical carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported EPS of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Thermo Fisher Scientific reported adjusted earnings per share of $2.31 in the third quarter of 2017, up 13.8% year over year. The company’s revenues grew 14% year over year to $5.12 billion.

Intuitive Surgical posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% on a year-over-year basis. Also, revenues increased 18% year over year to $806.1 million.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Original post