The lumber market has been more unsteady than oil-reliant economies in the Middle East recently.

That’s because the industry has been forced to react to a number of factors largely outside of its control lately. Like changing consumer interests, shifts in manufacturing operations, housing downturns, and, of course, a little toxic PR.

But it you have the cojones for short-term trends and volatility trades, the lumber industry is looking particularly enticing.

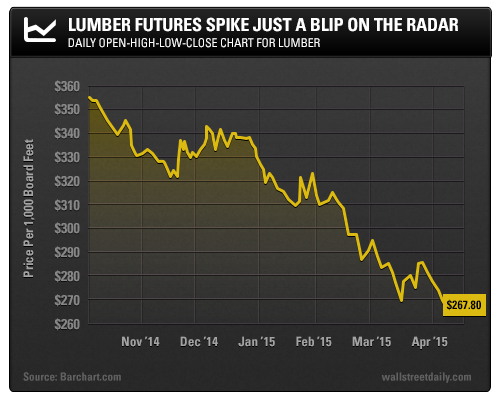

You see, lumber futures prices saw a nice $25 pop since my last “Buy” recommendation in March. The May contract was trading up to $290 per 1,000 board feet (mbf) from earlier when it was sub-$265.

But the rally proved unsustainable, as you can see in the chart below.

So what’s with the volatility? To find that out, we need to explore the influencing factors.

Getting to the Root of Lumber Prices

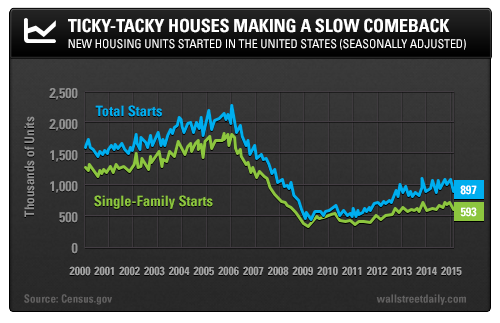

The first and most significant factor is the slow, yet inconsistent, rise in the number of new homes under construction since the financial crisis, in light of the zero-interest-rate policy. It’s particularly important when you assess housing starts statistics on a more granular basis. Investors should factor in the percentage of multi-family housing starts within total housing starts, as these units are less lumber-intensive than single-family detached houses.

Secondly, decreasing pesticide use could increase costs. Lumber has traditionally been treated with pesticides to repel insects and fungus. But with the recent Lumber Liquidators Holdings Inc (NYSE:LL) scandal, many lumber producers are considering switching to alternatives or eliminating them altogether. More lumber could be lost as a result, and a less-toxic alternative may be more expensive.

Fourth, recent environmental debates have had a huge effect on logging, as cutting down large swathes of forests has proven to harm various species and ecosystems, and contributes to global warming. The largest old growth logging sale in decades is scheduled for the Tongass National Forest in southeast Alaska, but comes with two lawsuits brought on by conservation groups protesting that the logging would undercut the region’s $2-billion fishing and tourism industries, and cause damage to vital habitats.Third, the number of global manufacturing plants in need of raw logs (as opposed to finished lumber) is growing. In 2014, the global softwood log trade reached an eight-year high of approximately 85 million cubic meters, according to estimates by Wood Resources International.

Fifth, Canada and the United States are major competitors in this industry – both nations having fought for decades to find equal footing on lumber pricing and subsidies. And the clock is ticking on the 2006 Softwood Lumber Agreement (SLA) between the United States and Canada – it’s set to expire in October 2015, well ahead of its original seven-year agreement.

The SLA prohibits the Canadian federal and provincial governments from providing subsidies to the Canadian lumber industry. The United States agreed to revoke antidumping and countervailing duty orders, while the Canadian government agreed to create export measures when the softwood lumber market breaks below US$355 per mbf. It’s now well under that level.

Sixth, the strength of the U.S. dollar has dampened the price of lumber, along with many other globally traded commodities priced in U.S. dollars.

Looking at all these factors, the tree rings may be telling us not to yell “timber” just yet.

Seeing the Forest for the Trees

Weak lumber prices won’t translate to a forward curve in perpetual contango. Lumber futures, like those of other markets without an active cash-and-carry arbitrage between contract months, tend to oscillate between backwardation and contango structures, thus demonstrating some interesting properties over time.

Currently, there’s a slight backwardation in the front months followed by a modest contango.

Lumber looks to have a bit more room on the downside, too – but in the medium term, prices should trend upward.

Global trade of softwood lumber has continued to trend upward ever since the 2008 financial crisis, according to the Wood Resource Quarterly.

In 2014, export volumes were up 5% to 8% for a majority of the largest lumber-exporting countries in the world, including Canada, Russia, Finland, Sweden, and Germany.

Lumber consumption in the United States increased 6.1% during the first 11 months of 2014, as compared to the same period in 2013.

Even while softwood log imports to China slowed in the fourth quarter of 2014, the year still set a record with the import value surpassing $5.4 billion!

Sprucing up Your Portfolio

The expiration of the Softwood Lumber Agreement is still over six months away, but the two governments are already discussing a new agreement. The Canadians are in favor of resigning the current agreement with few, if any, alterations.

The U.S. Lumber Coalition, representing much of the U.S. industry, says rubber-stamping the current SLA is a nonstarter.

But if the SLA expires in October without a new agreement in place, no trade cases can be filed for at least a year.

When it comes to lumber futures and options, your best bet is to be a short-term, tactical trader. Focus on housing starts and the U.S. dollar, while keeping a keen eye on Canada.

Good investing,