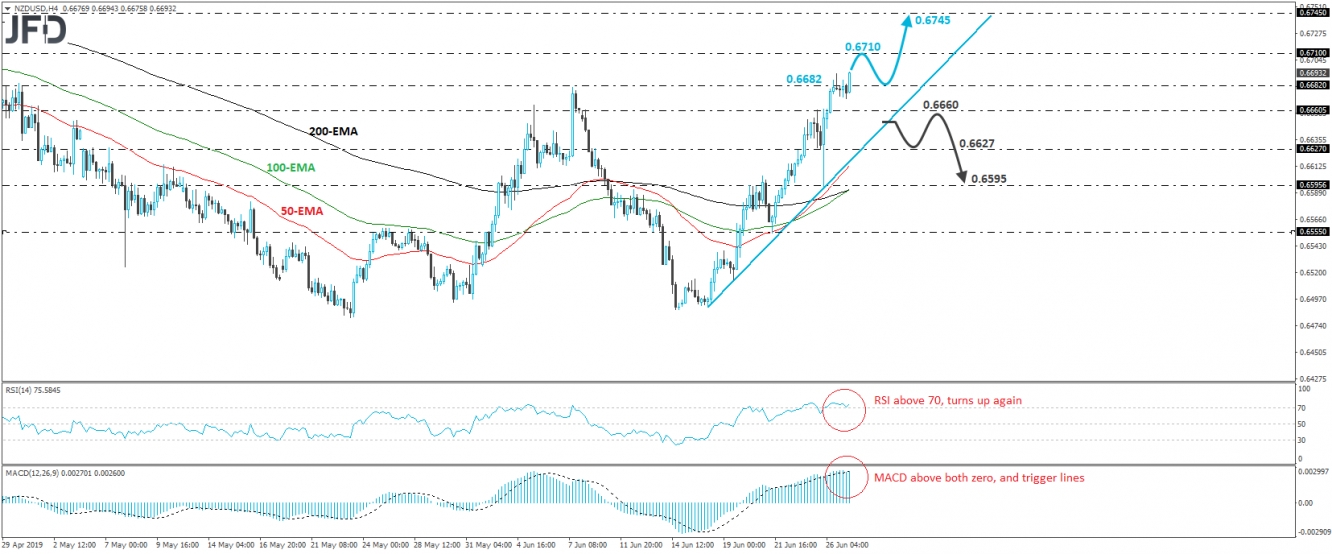

NZD/USD traded higher today, breaking above the key resistance (now turned into support) territory of 0.6682. That level provided strong resistance between April 26th and 30th, as well as on June 7th. What’s more, the pair has been printing higher peaks and higher troughs above an uptrend line since June 18th, which combined with the aforementioned break, keeps the near-term outlook positive in our view.

We believe that the break above 0.6682 may have opened the path towards the 0.6710 zone, marked by an intraday swing low formed on April 17th. If that level is too weak to stop the rate from drifting higher, its break may carry more bullish implications, perhaps setting the stage for the 0.6745 area, which acted as a support on April 16th and as a resistance the day after.

Shifting attention to our short-term oscillators, we see that the RSI, already above 70, turned up again, while the MACD lies above both its zero and trigger lines, though it has slowed. Both indicators detect upside speed, but the slowdown of the MACD makes us careful of a possible retreat at some point soon, perhaps after the rate challenges the 0.6710 hurdle.

That said, as long as the rate remains above the aforementioned short-term uptrend line, we would treat such a setback as a corrective move. In order to start examining a bearish reversal, we would like to see a clear dip below both the 0.6660 support and the uptrend line. Such a move could encourage the bears to take the reins and perhaps aim for the 0.6627 barrier. Another dip, below 0.6627, may allow the slide to continue towards the 0.6595 area, defined by yesterday’s low.