Earnings Expected Wednesday

Lululemon (NASDAQ:LULU) is expected to report earnings on Wednesday after the market closes. The activewear company beat its earnings estimates last quarter (Q3) and shareholders enjoyed a quick 10% price increase. However, shares have been trending lower since the beginning of 2017 as headwinds appear to be growing stronger.

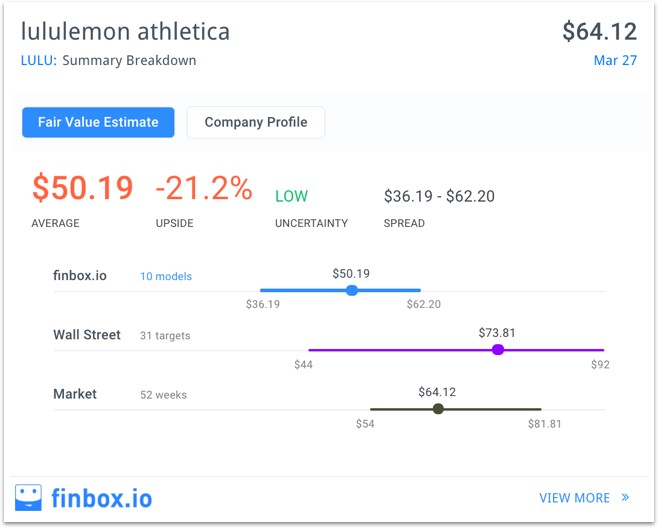

While the stock trades lower, Lululemon still appears to be approximately 20% overvalued when applying Wall Street estimates to ten separate finbox.io cash flow analyses.

Analysts Turn Bearish

On March 9th, Canaccord Genuity warned investors that the company’s apparel strategy could become less effective, citing new consumer preferences in denim. The investment bank conducted a survey which found that 18% of respondents expected to buy fewer pairs of Lululemon pants this year.

More recently, Macquarie’s Laurent Vasilescu highlighted 10 reasons investors should worry about Lululemon ahead of earnings. One interesting point that Vasilescu noted was saturation.

Christine Day was Lululemon’s CEO from 2008–2013 and under her management, the company often claimed that the total addressable market (TAM) in North America was 300–350 stores. As of last October, there were 287 stores in the North American region. Hence, the company may be reaching saturation.

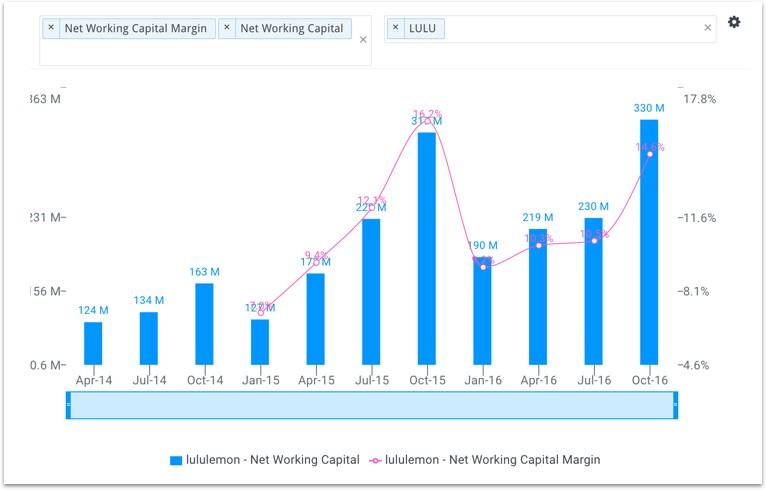

Another interesting point Vasilescu highlighted was the elevated level of inventories on the company’s balance sheet. Inventories make up a significant portion of Lululemon’s net working capital (NWC) and is also the main reason for the steady increase in NWC over the last eleven quarters (shown below).

In two years, the company’s NWC has more than doubled ($330mm in Oct ’16 vs $163mm in Oct ‘14). The increase in inventories and NWC implies that it is simply taking longer for Lululemon to sell its apparel — not a great sign.

Margins Declining From Intense Competition

Outside of shifting consumer preferences, Lululemon also faces stiff competition from established activewear providers like Athleta, Columbia Sportswear (NASDAQ:COLM), Gildan (NYSE:GIL), Nike (NYSE:NKE) and Under Armour (NYSE:UAA). In addition, the company will have to compete with new entrants like Ivy Park which is a new activewear brand co-founded by Beyoncé in 2016. Investors long LULU need to keep a close eye on Beyoncé’s new brand.

Approximately 75% of Lululemon’s revenue is derived from the US (way up from 50% in 2012). The US population stands at approximately 325 million people. Compare this to Beyoncé’s 98 million followers on Instagram which is roughly 30% of the entire US population. While the demographics of Beyoncé’s followers are unknown, her reach and influence on US consumers undeniable.

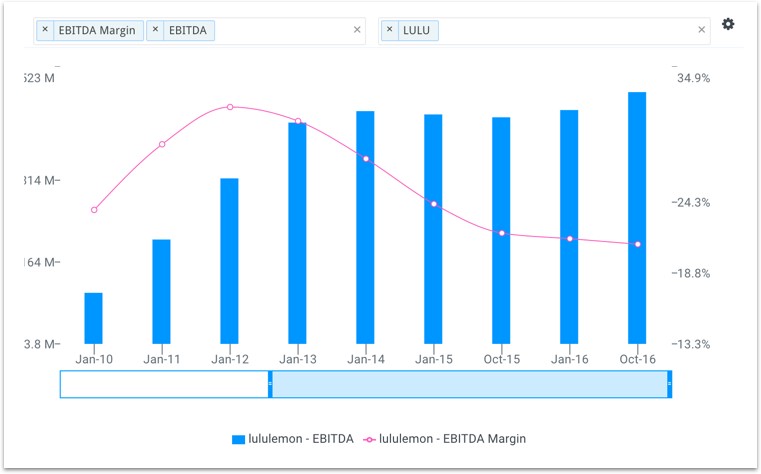

Stiff competition from established activewear brands have already started to erode Lululemon’s EBITDA margins as shown below. New entrants like Ivy Park will likely diminish margins even further.

Conclusion

Several analysts have recently turned more bearish on Lululemon and rightfully so. Competition has pushed inventory levels higher and margins lower.

In addition, finbox.io’s valuation analyses imply that the stock is 20% overvalued on purely a fundamental basis. Value investors may want to stay clear of LULU before the company reports earnings on Wednesday.