Wall Street has been hit with an onslaught of retail earnings in recent weeks. Today, traders are cheering strong results from sporting goods retailer Dick’s Sporting Goods Inc (NYSE:DKS), while tomorrow, yoga apparel maker Lululemon Athletica Inc (NASDAQ:LULU) will step up to the plate. Ahead of the company's first-quarter earnings report -- due after Thursday's close -- LULU stock is trading up 0.8% at $106.52.

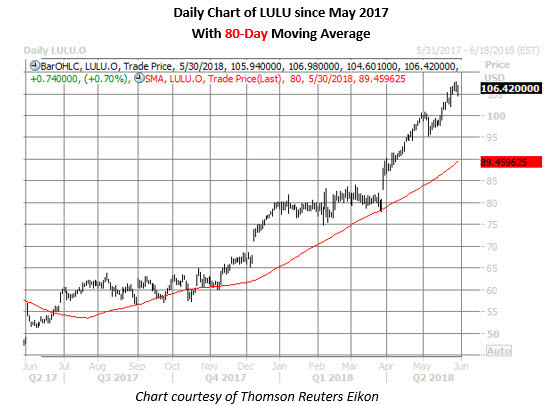

This upside is just more of the same for Lululemon, though, with the retail stock more than doubling in value on a year-over-year basis. More recently, the shares have surged nearly 36% since taking a sharp earnings-induced bounce off their 80-day moving average in late March, and hit a record high of $107.68 yesterday.

LULU stock could be headed even higher by week's end, if history is any guide. Over the past eight quarters, the security has gained ground in the session subsequent to earnings six times, including the most recent one in March. On average, Lululemon shares have swung 11% the next day, regardless of direction. This time around, the options market is pricing in a slightly bigger move of 13.1% for Friday's trading.

Options traders, however, have been bracing for a move to the downside. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), LULU's 10-day put/call volume ratio of 1.03 ranks in the 76th annual percentile, meaning puts have been bought to open over calls at a quicker-than-usual clip in recent weeks.

While some of this is likely a result of shareholders initiating portfolio protection, there's plenty of skepticism priced into the stock outside of the options pits. For starters, 12 of the 25 analysts covering the shares maintain a lukewarm "hold" recommendation. Plus, the average 12-month LULU price target of $96.46 stands at a discount to current trading levels.

Elsewhere, short interest is up almost 27% since mid-February to 4.55 million shares. While this accounts for a low 4.3% of Lululemon stock's available float, it would still take almost three days to cover these bearish bets, at the equity's average pace of trading. Another positive earnings reaction for LULU could prompt a round of bullish brokerage notes and/or short covering, with could translate into bigger tailwinds for the retail shares.