Athletic apparel maker lululemon athletica inc (NASDAQ:LULU) late Wednesday posted better than expected third quarter earnings results and announced a new share buyback plan.

The Vancouver-based company reported Q3 EPS of $0.50, which was $0.07 better than the Wall Street consensus estimate of $0.43. Revenues rose 13.5% from last year to $544.4 million, also beating out analyst estimates for $539.94 million.

Lululemon said that gross profit surged 24% to $278.4 million in the latest period. As a percentage of net revenue, gross profit was 51.1%, up from 46.9% in Q3 of 2015. Meanwhile, inventories at the end of the third quarter rose 2% to $364.5 million, which was lower in dollar terms than Q3 of last year.

Looking ahead, LULU forecast Q4 EPS ranging from $0.96 to $1.01, which is roughly in line with the $1.00 that analysts are looking for. The company sees Q4 revenues of $765 to $785 million, which would miss Wall Street’s $786.74 million view. LULU also forecast comparable sales rising in mid-single digits, excluding currency effects. Lululemon’s board of directors approved new $100 million share buyback program as well.

The company commented via press release:

Laurent Potdevin, lululemon’s CEO, stated: “Our third quarter results demonstrated strong execution across all areas of our business as we delivered continued topline momentum, outperformed in gross margin and inflected meaningfully in EPS. This success is a result of our team’s ongoing effort and commitment to delivering on our long term strategies.”

Mr. Potdevin continued: “As we entered the fourth quarter, we experienced mixed sales results that have since improved. I am inspired by the team’s response and passion towards making this another successful holiday season, and I am confident that we will continue to deliver an unparalleled guest experience across all our channels and regions around the globe.”

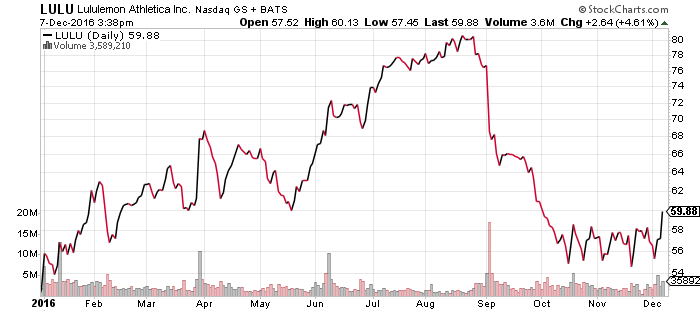

Lululemon shares surged $6.46 (+10.80%) to $66.30 in after-hours trading Wednesday. Prior to today’s report, LULU had gained 14% year-to-date, beating out the benchmark S&P 500’s 10% rise in the same period.