Over the past 15 years, Yahoo (O:YHOO) has lost nearly 70% of its peak value (and this is taking into account its utterly and completely lucky gains from Alibaba (N:BABA)). During those fifteen years – – and let’s remember, on the day of Yahoo’s price peak, Mark Zuckerberg was a 15 year-old high school student – – Yahoo has struggled mightily to recapture its lost glory, only to fail again and again, in spite of a series of blonde female CEOs whose principal difference appears to be whether they use profanities in public or not.

As a person who has been online since 1981 (literally), I have a strong sense as to what’s good and what isn’t so good, and I’ve always thought Yahoo sucked out loud. It’s astonishing to me that they are ever still around. And, in a way, they are not, because their enterprise value was recently calculated as negative thirteen billion dollars.

Now the fact that Marissa Mayer has made her vast fortune by being really, really lucky (first, as an early Google (O:GOOGL) employee, with a key qualification being outlined in this link, and later, as a PR stunt, as the pretty new face of Yahoo) is something that’s been covered repeatedly in the hallowed halls of Slope. However, I saw something earlier this week that just made me roll my eyes again, as the world proved once again how Mayer gets a “pass” on the Yahoo debacle by being consistently fertile (and yes, these are seriously the news headlines for the company):

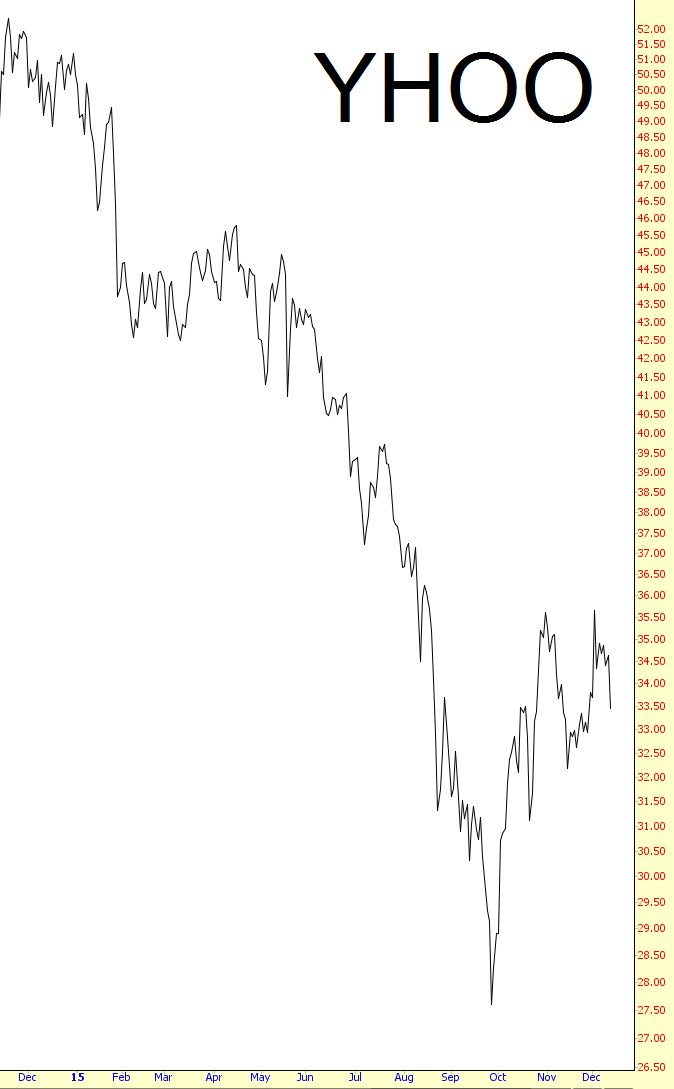

I have no problem with people getting fantastically rich by creating value. The tens of billions that Elon Musk, Mark Zuckerberg, Larry Paige, Sergey Brin, and Jeff Bezos have made – – God bless ’em! But Yahoo stumbled onto a good investment with Alibaba (long before Mayer showed up), and because the world happened to go crazy about Chinese internet stocks at just the right time, it saved Yahoo from bankruptcy. And even with this huge advantage, here’s the kind of performance Yahoo has seen lately, led by everyone’s favorite narcissist:

(Note: I actually took that screenshot a few days ago; the stock is even worse off now – Tim).

I think the reason she gets a free pass is because people are afraid of appearing sexist. I dismiss this notion based on two important facts: first, that any CEO who had stumbled so badly (and become so rich doing so) deserves scorn, whether they are male or female. And second, If anyone on this planet could be accused of tying Marissa Mayer’s sexuality to her career, I think one need look no farther than the woman herself: