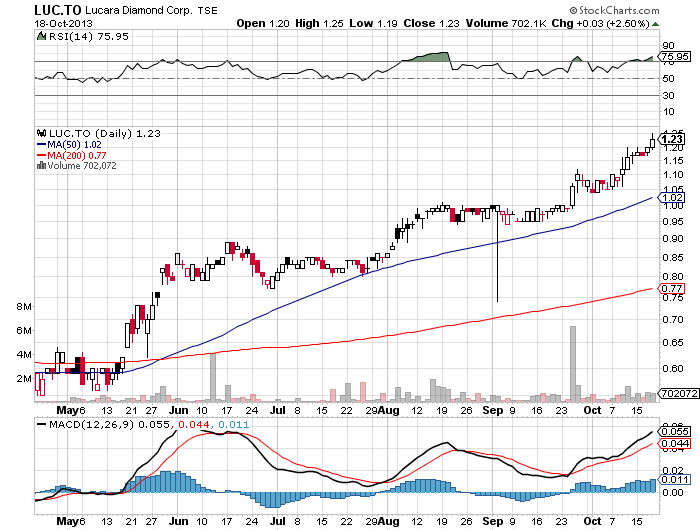

The Lundin Group’s Lucara Diamond Corp. (LUC) reached a 52 week high of $1.25 Friday, with shares in the African diamond producer closing at $1.23 on approx. 700,000 shares.

Lucara’s shares have more than doubled since the company entered production at its 100% owned Karowe diamond mine in Botswana in August, 2012, giving the junior miner a market cap of greater than $460 million today, with the Lundin’s position worth at least $84 million, according to insider filings.

The company’s run is a result of outperformance at Lucara’s flagship Karowe mine in Botswana, where rich stones (some 250+ carats) keep coming out of the Karowe kimberlite pipe, awing investors and auctioneers alike (Sales proceeds in excess of $80 million and over 230 thousand carats sold for the first six months of 2013). Sources in the institutional investment community tell us Lucara will soon be in a financial position to acquire additional projects or even pay a dividend. Diversification will become important for Lucara in its next stages of growth as investors never love one asset producers, and by the sounds of it the company’s Mothae project in Lesotho will not get built. However, given the Lundin’s financial strength, and the depressed and unloved state of the junior mining market, there should be opportunities for the company to pick up other assets. I would never bet against the Lundin’s and see LUC’s share price continuing to be strong here.

Disclaimer: These are opinions and not advice. All figures approximate and all facts to be verified by the reader. This is not investment advice. Always do your own due diligence. Thank you.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Lucara Diamond: Hits 52 Week High, Last At $1.23

Published 10/20/2013, 02:07 AM

Updated 07/09/2023, 06:31 AM

Lucara Diamond: Hits 52 Week High, Last At $1.23

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.