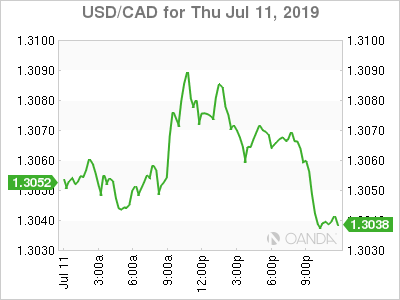

The Canadian dollar is higher on Thursday after the Fed continued to issue dovish rhetoric and feeding the market’s expectations of a rate cut to be delivered later this month when the FOMC meets. The Bank of Canada (BoC) had some dovish words as well on Wednesday, and in a true battle of the doves, the Fed won if only because after Fed Chair finished his testimony before the congressional committee the notes from the June FOMC were published.

BoC Governor Poloz was as mixed as the economic indicators. The central bank sees some of the recovery as transitory, and will be on the lookout for signs of deceleration. The BoC is not expected to intervene directly in the market this year as the rise of inflation and solid job data is giving the central bank some breathing room.

The Fed on the other hand cannot afford to be seen as patient, given market expectations and the pressure from the White House to lower rates now rather than later.

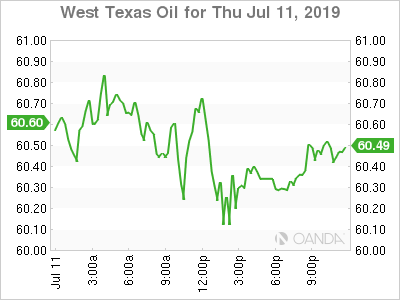

OIL – OPEC Lower 2020 Forecasts Sink Crude

Crude fell on Thursday after the Organization of the Petroleum Exporting Countries (OPEC) released its 2020 demand forecasts and showed a drop in crude appetite by 1.34 million barrels. West Texas Intermediate dropped 0.22 percent and Brent 0.64 percent despite the US reporting a larger than expected drawdown yesterday and rising Middle East tensions.

Britain seized an Iranian tanker and could lead to Iran following through on its threats to close the Strait of Hormuz. Tropical Storm Barry is headed towards Texas and producers have already shut down platforms. The storm could be upgraded to hurricane with a deeper impact on US supply of crude.

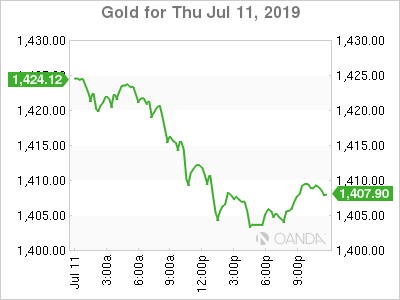

GOLD – Profit Taking Takes Gold Down a Peg

Gold dropped 0.22 percent on Thursday after a bout of profit taking took the yellow metal to just above the $1,400 price level. The dovish rhetoric from the Fed continues and the debate around interest rates in the U.S. is not on hold or cut, but rather cut by 25 basis points or 50?

The sustained dovish turn by the Fed since January has been a positive for gold as it reclaimed its safe haven crown with geopolitical tension rising.